Sunday night’s debate was predictably dominated and overshadowed by the spectacle of the preceding several days. In the midst of all the hostility and frequent, baffling pivots to ISIS, however, Donald Trump paused to answer a question from an audience member on how he would change the tax code to ensure that “the wealthiest Americans pay their fair share in taxes.”

Here’s the relevant portion of Trump’s response:

We’re getting rid of carried interest provisions. I’m lowering taxes actually, because I think it’s so important for corporations, because we have corporations leaving — massive corporations and little ones, little ones can’t form. We’re getting rid of regulations which goes hand in hand with the lowering of the taxes.

But we’re bringing the tax rate down from 35 percent to 15 percent. We’re cutting taxes for the middle class. And I will tell you, we are cutting them big league for the middle class.

And I will tell you, Hillary Clinton is raising your taxes, folks. You can look at me. She’s raising your taxes really high. And what that’s going to do is a disaster for the country. But she is raising your taxes and I’m lowering your taxes. That in itself is a big difference. We are going to be thriving again.

Trump has, in fact, pledged to get rid of the carried-interest provision, the loophole that allows private equity managers and some hedge fund managers to pay very low tax rates. Clinton has too.

Nothing else in Trump’s statement seems to be factually accurate. As I reported earlier this year, Trump’s tax plancalls for a simplification of the tax code, the elimination of a variety of loopholes, the elimination of the estate tax, a cap on the federal income tax rate (of 33 percent), and a ceiling on the corporate tax rate (of 15 percent).

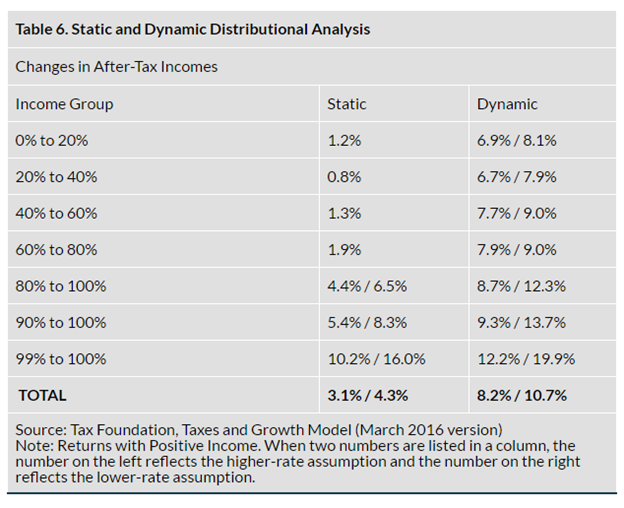

None of this, it turns out, results in a tax code in which the wealthy pay their fair share.In September, the Tax Foundation, a right-leaning think tank, released an analysis of Trump’s current tax plan. It found (as the chart to the left illustrates) the benefits would overwhelmingly accrue to wealthier Americans. (And a separate analysis by the New York Times notes some special perks for real estate developers.)

The Tax Foundation analysis concluded that middle-income Americans (those in the 40th to 60th percentile of the income distribution) would see a 1.3 percent increase in after-tax income under the Trump plan, while those in the top 1 percent of the income distribution would see an increase of 10 to 16 percent. I have not, as yet, been able to find an official economic definition of what exactly constitutes a “big league” tax cut, but a tax plan that delivers its biggest gains to the highest earners can hardly be described as one that will ensure the wealthiest Americans pay their fair share.

The Clinton plan will raise taxes on high earners, while the Trump plan will provide enormous tax cuts for the wealthiest Americans.

Furthermore, a detailed recent analysis by Lily Batchelder, a professor at New York University School of Law, suggests that some middle-income families may actuallysee their tax bill go up under the Trump plan. Looking at how Trump’s proposals would affect individual Americans, Batchelder concludes that the plan would increase taxes for 20 percent of households with children and over half of single-parent households. All in, Batchelder estimates that, conservatively, 7.8 million families would see higher tax rates under the Trump plan. (The Trump campaign has disputed Batchelder’s findings, although a researcher at the Tax Foundation told the Washington Post that the findings sound “plausible.”)

Clinton’s plan also calls for tax increases, but those increases will fall almost exclusively on top earners. An analysis of her plan by the left-leaning Tax Policy Center finds that low- and middle-income households will see a very small decline (less than 0.2 percent) in after-tax income (due to the effects of the plan on wages), while higher-income Americans will see their tax bills go up under the Clinton plan.

The chart to the left, from a Tax Policy Center blog post on the topic, illustrates how the Clinton plan would affect after-tax income for earners across the distribution. The analysis doesn’t account for the effects of several recent tax breaks Clinton has proposed, including one announced this morning that would substantially expand the Child Tax Credit, thereby raising the after-tax income of eligible low- and middle-income families.*

Put simply, the Clinton plan will raise taxes on high earners, while the Trump plan will provide enormous tax cuts for the wealthiest Americans.

*Update — October 11, 2016: This article has been updated to include details on Hillary Clinton’s newly announced Child Tax Credit.