Last night, Hillary Clinton laid out her economic plan for the country. And it’s about more than just economics.

By Dwyer Gunn

Hillary Clinton accepts the nomination during the final night of the Democratic National Convention in Philadelphia, Pennsylvania. (Photo: Saul Loeb/AFP/Getty Images)

Last night, at the close of the Democratic National Convention, Hillary Clinton formally accepted her party’s nomination for president. Clinton’s acceptance speech, which touched on a wide range of topics, included a lengthy section on her economic plan for the country. “My primary mission as president will be to create more opportunity and more good jobs with rising wages right here in the United States,” Clinton promised. “From my first day in office to my last!”

Clinton’s promise is a big one, but that doesn’t mean it’s an empty one. This morning, Moody’s Analytics released a report concluding that Clinton’s economic plan would create 3.2 million jobs and accelerate growth of the nation’s gross domestic product (GDP). By contrast, earlier this month, a similar (albeit contested) Moody’s analysis of Trump’s economic plan estimated that it would reduce employment (by about 3.5 million jobs), reduce economic output, and prompt a painful recession.

The cornerstone of the plan is a massive — $275 billion over five years — infrastructure investment in the country’s roads, bridges, airports, and clean-energy capabilities.

The proposals that Clinton described last night aren’t new, but as the country heads into a general election in which the economy figures to be a major talking point, it’s worth pausing to consider her plan in its entirety. The cornerstone of the plan is a massive — $275 billion over five years — infrastructure investment in the country’s roads, bridges, airports, public transit, and clean-energy capabilities. It’s an investment that Trump agrees is sorely needed, given the deplorable state of American infrastructure, and it’s a plan that economists almost universally adore (although some have argued for an even larger investment).

In addition, Clinton has pledged to revoke tax breaks for companies that move production overseas, provide tax incentives to companies that engage in profit-sharing schemes (another idea that economists like), make college more affordable, and increase the minimum wage. Clinton’s economic plan also incorporates a number of proposals that might not, on the surface, seem like they have much to do with economic growth—specifically, immigration reform and a greater attention to family friendly proposals like paid family leave and more affordable childcare — but will undoubtedly spur the economy.

Consider immigration reform, for example. Here’s what Clinton had to say on the topic last night:

I believe that when we have millions of hardworking immigrants contributing to our economy, it would be self-defeating and inhumane to kick them out. Comprehensive immigration reform will grow our economy and keep families together — and it’s the right thing to do.

She’s right. The positive economic effects of immigration reform are vastly underrated and under-hyped. Bringing America’s undocumented workers out of the shadows will result in more workers paying taxes and contributing to the formal economy. In fact, it might be the only way to save Social Security once the Baby Boomers start retiring in a few years.

Back in 2014, the Council of Economic Advisors estimated that the president’s executive actions on immigration (actions which pale in comparison to comprehensive immigration reform) would increase economic output by up to 0.9 percent over 10 years, increase the productivity of all workers, increase wages for both U.S.-born and immigrant workers, and reduce the federal deficit by $25 billion by 2024. In an op-ed for CNN, Jason Furman, the chairman of the Council of Economic Advisors, described immigration reform as “one of the biggest levers the United States has to encourage economic growth and to raise wages.”

“The Organisation for Economic Co-operation and Development and the International Monetary Fund recently found that President Barack Obama’s growth strategy, which he presented at the recent G-20 meeting in Brisbane, Australia, would add more to our economy than the steps being pursued by any other G7 country,” Furman wrote. “And the single biggest contributor to that strategy? Immigration reform.”

Clinton’s economic plan would create 3.2 million jobs.

Meanwhile, the family friendly policies that Clinton supports — paid leave, universal pre-kindergarten, and increasing the quality and affordability of childcare, etc. — are expected to increase the labor force participation of another marginalized group of American workers: women. In fact, in a report released earlier this year, the OECD found that the country’s family unfriendly policies were a barrier to economic growth.

The OECD report also highlighted a number of policies the U.S. might pursue. Closing the gender gap in labor force participation, for example, would increase GDP per capita by $4,300. The report also called for a number of other reforms — improvements to the criminal justice system, better education for low-income children, better job training, and so forth — meant to increase labor force participation and improve the economic prospects of marginalized Americans.

In one of the best-received lines of her speech last night, Clinton detailed exactly how she plans to pay for these proposals. “Now, here’s the thing, we’re not only going to make all these investments, we’re going to pay for every single one of them. And here’s how: Wall Street, corporations, and the super-rich are going to start paying their fair share of taxes,” she said, to thundering applause. “Not because we resent success. Because when more than 90 percent of the gains have gone to the top 1 percent, that’s where the money is.”

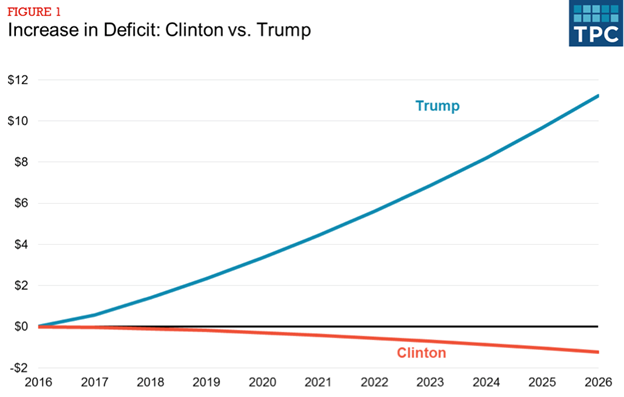

To be sure, Clinton’s numbers add up. According to the Tax Policy Center, her economic plan would not increase the federal deficit (unlike, Trump’s economic plan, which would massively increase the deficit):

(Chart: Tax Policy Center)

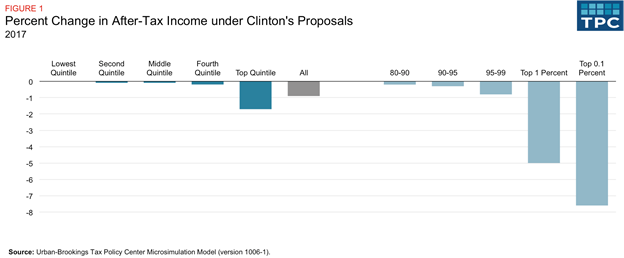

And here’s who would be affected by the tax increases the candidate has proposed:

(Chart: Tax Policy Center)

Earlier this year, the Brookings Institution held a panel that focused on preparing for the next recession. At the panel, Larry Summers, secretary of the Treasury under Bill Clinton and a prominent liberal economist, called for a new focus on economic growth, describing it as “the most important determinant of our long-term fiscal picture.”

“[A]re we pursuing the things that would constitute a growth agenda?” Summers asked. “Whether it’s immigration reform, whether it’s family leave to support increased labor force participation, whether it’s tax reform to motivate more investment to take place at home, whether it’s regulatory policies that are devoted to spurring growth, whether it’s building an adequate public investment infrastructure, we are not in a large and concerted way doing any of those things.”

The attentive observer will note that Clinton’s plan for the American economy checks almost every one of those boxes, without raising the federal deficit or increasing taxes on lower- or middle-income workers.

||