Between 2011 and 2013, warehouses across Southern California were stuffed with millions upon millions of Chinese-made solar panels. How the panels got here, and what ultimately became of them, is one of the oddities of global trade.

“Chinese solar panels dominated tons of warehouses in Carson,” says Rafael Galante, principal consultant of L.A. Source Consulting, who witnessed the influx of solar modules from China in early 2012. “They were everywhere.”

The story began a few years earlier, with the Chinese government’s growing panic about one of its biggest national threats: lung-clogging air pollution. Chinese officials decided in 2010 that solar power would be the centerpiece of a five-year plan—one of Beijing’s massive centralized planning initiatives. The government worked with the China Development Bank to flood the country’s solar manufacturers with $42 billion in subsidized loans between 2010 and 2012.

The cheap money turned the world’s biggest carbon emitter into the world’s largest solar panel maker nearly overnight. In 2010, China produced enough panels to generate 10,922 megawatts of electricity (about five times the capacity of the Hoover Dam), equivalent to 45 percent of new solar panel production worldwide. By 2012, that had risen to 20,903 megawatts, or 56 percent of total global production. As Chinese factories churned out panels, prices around the world fell. Between 2009 and 2011, the price of solar panels dropped from $2.79 to $1.59 per watt, pushing many American solar companies into bankruptcy.

The tariffs shrank the U.S. demand for Chinese panels just as Chinese firms’ manufacturing capacity was becoming dependent on foreign markets. More than 90 percent of panels made in China were exported abroad, rather than being installed within the country.

“The Chinese are so good at manufacturing at mass quantities that they brought the price of solar panels way down to the point where no one could keep up,” Galante says.

By 2011, American manufacturers had begun to cry foul, complaining that the cheap government loans had given Chinese firms an unfair advantage. They began to lobby Washington to take action, insisting that China had violated the terms of global trade. They wanted the United States to levy tariffs on the cheap imports.

That’s when boatload after boatload of panels began to show up at the Los Angeles and Long Beach ports.

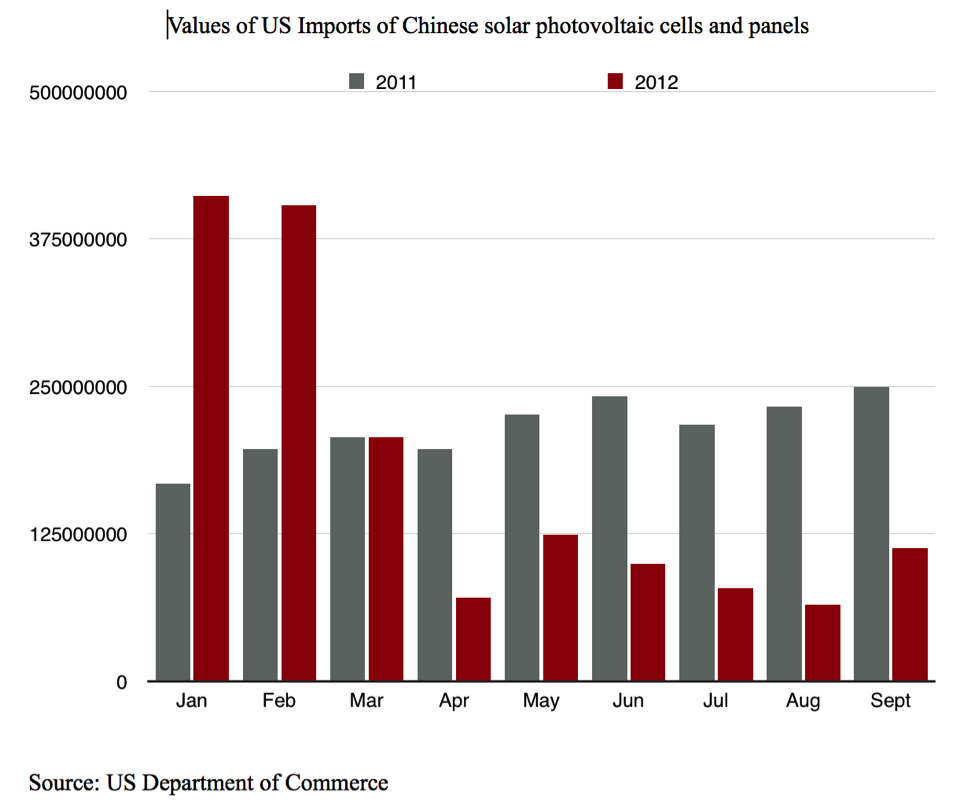

“Many Chinese makers knew the tariffs would be around the corner then, so they flooded American ports with panels,” says Evan Fu, CEO of Energo Solar, a solar installer based in Los Angeles. By November 2011, Chinese panel imports had risen 347 percent from the same period a year earlier.

According to data from the Port Import and Export Reporting Service, Changzhou Trina Solar Energy Co. Ltd., a top Chinese solar panel maker, imported 209 percent more in the first half of December in 2011, compared with the same period in 2010. Imports from Suntech Power Holdings Co., Ltd., one of the largest solar manufacturers at the time, were 76 percent higher in November 2011 than they had been a year earlier. Randy Chang, who ran the Los Angeles-based sales office for a Chinese panel manufacturer he preferred not to name, says his company imported hundreds of shipping containers of panels in the beginning of 2012.

Chinese manufacturers stockpiled some of these panels as part of a sales strategy. “Some companies have a sales branch in the U.S and they imported their own panels to make the numbers look nicer,” Chang says.

Others had been requested by U.S. companies—though the companies didn’t always have immediate plans to use them. Between 2009 and 2012, the Treasury Department was offering cash grants to companies that developed renewable energy projects in the U.S. To qualify, developers had to first show that they had already laid down money for the first 10 percent of the investment. One of the easiest ways to do that was to purchase solar panels, even if they didn’t have a place to install them yet. Developers would often purchase panels from China simply as a way to unlock the cash from Treasury, Chang says.

The rise in solar panel prices after tariffs meant that companies that had stockpiled panels couldn’t always offload them. And it contributed to many of the already-purchased solar panels languishing in storage. Building a solar farm generally takes three to four years, and plenty of hurdles can arise along the way. “Some of the developers might not find the proper land to install panels and some of them might not be approved to connect to the power grid,” Chang says. Many solar farms that had been planned were never built, leaving the unused panels stuck in the warehouses.

The tariffs Chinese manufacturers feared came through in May 2012. The U.S. Commerce Department levied tariffs of more than 31 percent on imports of Chinese solar panels, a significant blow to China’s solar makers.

The tariffs shrank the U.S. demand for Chinese panels just as Chinese firms’ manufacturing capacity was becoming dependent on foreign markets. More than 90 percent of panels made in China were exported abroad, rather than being installed within the country, according to a report from China Electricity Council. As exports shrank, the balance sheets of many Chinese companies began to bleed. A number of them went out of business. Suntech Power, based in Wuxi, China, one of the world’s largest solar panel makers with about 11,000 workers, filed for bankruptcy in March 2013.

Panel prices tumbled more, about 35 percent in 2012. “People didn’t know when the bottom would be, so they chose not to buy them,” Chang says.

Chang now was charged with finding new buyers for this massive supply. In order to get rid of the massive stockpile, Chang sold them at 50 to 60 cents per watt, while the market price was 70 to 80 cents.

Even at steep discounts, Chang only sold two to three megawatts worth. “Millions of cheap panels became leftovers in the warehouses,” Chang says. The stockpiling situation didn’t improve, but the technology did.

“As the technology improved, the new panels became more efficient, which makes old panels obsolete very quickly,” says Jonathan Port, CEO of Permacity, a solar installer in Los Angeles.

Installing older, weaker panels is actually more expensive than installing newer ones. Installation fees are tallied on a per-watt basis. Since old panels generate fewer watts than the new ones, workers have to install more of them for each project, which requires more time and labor. “Old panels are like old cars that don’t have leather seats. We don’t want them,” Port says.

In addition, many Chinese companies had gone bankrupt and could no longer guarantee the 25-year warranty, which is standard in the industry. “It’s too big an investment to take the risk to buy panels from a bankrupt company,” Port says.

What happened to the millions of leftover panels? “They were shipped out of the country and sold to the Third World counties,” says Michael Ho, a former employee of Total Transportation Concept Inc., a shipping company based in Los Angeles.

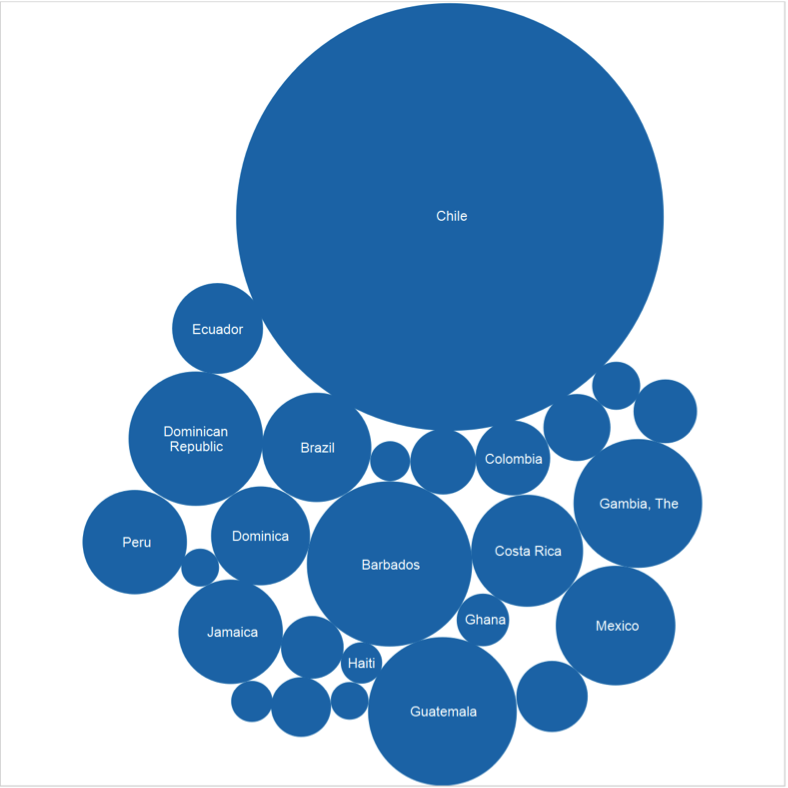

According to Total Transportation Concept data, around 1,100 tons of solar modules, with a capacity equal to roughly 140 megawatts, traveled from the U.S. ports to Africa, Central America, and South America in 2013. Top destinations were ports in Chile, Barbados, and Guatemala.

There is no way to be sure all 140 megawatts of panels were Chinese-made, says James Dearruda, Total Transportation Concept’s chief executive. “But 90 percent are from China transshipping via U.S.A.,” i.e. using the U.S. as a shipping waystation, he adds.

The re-shipment of solar panels made in China from the U.S. to the developing world surged even more in 2014—by 173 percent compared with 2013.

Despite the stiff tariffs from the U.S., including those imposed last year, China keeps rolling out more and more solar panels. In 2013, Chinese manufacturing enterprises made more than 70 percent of world’s solar modules, according to Hanergy Global Renewable Report 2014. But they’re no longer piling up in California ports.

This story is part of our week-long special report on energy issues in California produced in collaboration with the University of Southern California’s Annenberg School for Communication and Journalism. For more, visit the project’s landing page.