I’d hope that someone who has written a book about “What Shapes Our Fortunes” would have had Sociology 101 where he would have learned the fundamentally different ways that income and wealth work in our economy. But apparently not.

In “From Rags to Riches to Rags,” Mark Rank writes that because of a great deal of turbulence in household earning over a lifetime “we have much more in common with one another than we dare to realize.”

One of the reasons for such fluidity at the top is that, over sufficiently long periods of time, most American households go through a wide range of economic experiences, both positive and negative. Individuals we interviewed spoke about hitting a particularly prosperous period where they received a bonus, or a spouse entered the labor market, or there was a change of jobs. These are the types of events that can throw households above particular income thresholds.

Ultimately, this information casts serious doubt on the notion of a rigid class structure in the United States based upon income. It suggests that the United States is indeed a land of opportunity, that the American dream is still possible — but that it is also a land of widespread poverty. And rather than being a place of static, income-based social tiers, America is a place where a large majority of people will experience either wealth or poverty — or both — during their lifetimes.

All together now: Income, that comes in household paychecks, regardless of how many earners are contributing to that household income, is not wealth. Wealth is how much money a household has in the bank and in investments and the assets they own, like real estate, businesses, land, cars, boats, and planes.

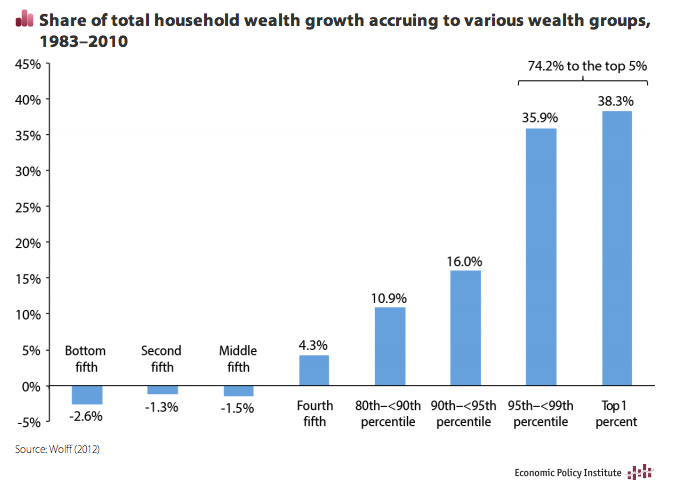

Wealth inequality is much greater than income inequality. It looks like this:

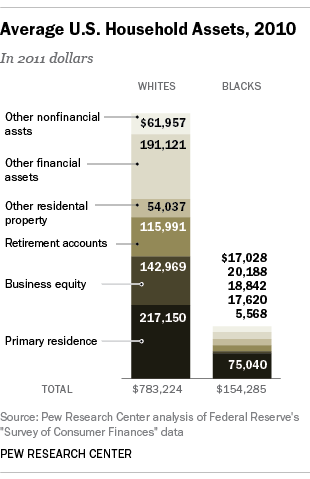

And breaking it down by race:

It is no small thing for any household to attain an annual income of a million dollars for even one year.

But it is an entirely different experience to have enough wealth that one can no longer worry about income at all, can work the tax system to mask enormous amounts of income, can essentially withdraw from everyday contact with everyday Americans, can use one’s wealth to leverage political and economic power, and can know that the children in one’s household will never, ever want for a thing.

The “one percent” was never about income alone.

This post originally appeared on Sociological Images, a Pacific Standard partner site, as “Income Is a Poor Measure of Income Inequality.”