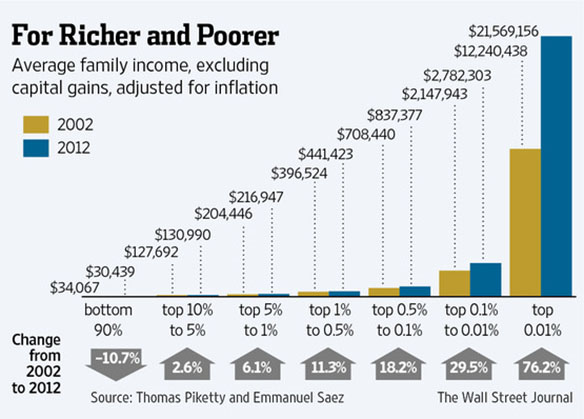

According to an article at the Wall Street Journal, the average income for the bottom 90 percent of families fell by over 10 percent from 2002 to 2012 while the average income for families in all of the top income groups grew. The top 0.01 percent of families actually saw their average yearly income grow from a bit over $12 million to over $21 million over the same period. And that is adjusted for inflation and without including capital gains.

What was most interesting about the article was its discussion of the dangers of this trend and the costs of reversing it. In brief, the article noted that many financial analysts now worry that inequality has gotten big enough to threaten the future economic and political stability of the country. At the same time, it also pointed out that doing anything about it will likely threaten profits. As the article notes:

But if inequality has risen to a point in which investors need to be worried, any reversal might also hurt.

One reason U.S. corporate profit margins are at records is the share of revenue going to wages is so low. Another is companies are paying a smaller share of profits on taxes. An economy where income and wealth disparities are smaller might be healthier. It would also leave less money flowing to the bottom line, something that will grab fund managers’ attention.

Any bets how those in the financial community will evaluate future policy choices?

This post originally appeared on Sociological Images, a Pacific Standard partner site.