LAST JUNE, AUSTRALIA completed its twenty-first consecutive year of economic growth. That’s a record, Treasurer and Deputy Prime Minister Wayne Swan pointed out, no other advanced economy can come close to matching.

It’s even more impressive given that this performance has spanned the Asian financial crisis of 1997–98, the dot-com boom and bust, and the international financial cataclysm triggered by Lehman Brothers’ fall in 2008. During each of these economic calamities, local and international doomsayers were quick to predict that, this time, Australia’s good run would come to an abrupt end. Yet each time, the economy sailed on.

There are now two quite different interpretations of Australia’s experience over the past two decades.

Call the first the Australian model. This view reckons that Australia offers a potentially attractive example of how to thrive in a turbulent global economy in which economic weight is shifting to Asia. According to the Australian model, a range of economies—from resource-rich emerging markets like Brazil and Chile to developed countries now struggling with low growth and high unemployment—could learn from Australia’s success.

The second interpretation argues that the harsh reality is that Australia has done little more than ride its luck and benefit from a temporary boom in global commodity markets. When the resource cycle turns, so will Australia’s economic performance. Call this view the Australian bubble.

Which of these is closest to the truth? It’s an important question for countries tempted to look to Australia to learn policy ideas, for businesses deciding whether or not to bet on Australia’s recent success, and for investors deciding whether to continue to treat the economy as one of a dwindling number of AAA-rated safe havens. Of course, it’s even more important for Australians themselves.

To a large extent, the answer lies firmly within Australia’s own control.

There is no doubt that Australia has benefited from a once-in-a-generation commodity boom, and from the great good luck of being in the right place at the right time. Yet good luck often requires hard work. Australia had to have the right policy framework in place both to make the most of that good luck and to ride out the international economic turbulence that capsized so many other advanced economies in the meantime.

Now, as the peak of the resource boom passes, Australia has to demonstrate that it can use some of its other advantages—a skilled and educated workforce; strong political, social, and economic institutions; an impressive economic policy record; and a location near some of the world’s most dynamic economies—to build on the successes of the past two decades. If it succeeds, the Australian model will be a guide for other countries and businesses. If it fails, the epitaph for the past 20 years will be, “It was only a bubble.”

IS THE LUCK RUNNING OUT?

In September of 1991, Australia’s economy started to grow, and it hasn’t really stopped since. Something like half the members of Australia’s current workforce have yet to experience a recession during their working lives.

This performance is not only Australia’s best for at least a century. It’s also the best growth performance of any developed economy over the past two decades. Today, while policymakers in the United States and across much of the rest of the developed world struggle with sluggish growth, burdensome debts, gaping fiscal deficits, and stubbornly high unemployment rates, Australia can boast a growing economy, a low unemployment rate, and a government budget and debt position that most other developed economies can only dream of. A decent showing for a country that Singapore’s then Prime Minister, Lee Kuan Yew, warned in 1980 could become the “poor white trash of Asia.”

Prime Minister Julia Gillard is straddling maintaing alliances with the U.S. and economics with China. (PHOTO: SAUL LOEB/AFP/GETTY IMAGES)

But is the luck running out? Despite what might almost seem to be an excess of good economic news in these troubled times, the current Australian mood is relatively somber.

In part, this just reflects the precarious state of the global economy, in which the ongoing crisis in the Eurozone, a sluggish recovery in the United States, and a downward shift in the pace of Chinese growth are all creating uncertainty.

More specifically, a fair amount of Australia’s recent economic success can be traced to the global commodity boom, which saw Australia’s terms of trade—the ratio of the price Australia gets for its exports to the price it pays for its imports—reach record highs.

But Australia’s terms of trade peaked in 2011. Slower economic growth in China means that the resource bonanza no longer looks as much of a sure thing as it did even a year ago. As a result, for the first time in 20 years, Australians are finding themselves debating a future beyond the commodity boom.

The economy has other vulnerabilities. Although the period following the global financial crisis saw households increase savings and pay down debt, they still carry a fairly high debt burden and, despite recent falls, house prices remain relatively high. The high Australian dollar has squeezed the international competitiveness of the nonresource sector.

Uber-pessimists worry about a perfect storm in which an economic crash in China would send global commodity prices plunging, crash Australia’s terms of trade, hammer Australian incomes, drive up unemployment, and send house prices into a downward spiral—Australia’s own mini-financial meltdown, payback for all those comfortable boom years.

THE RESILIENCE FACTOR

They could be wrong. Australia already faced a series of tough stress tests, beginning with the East Asian meltdown in the late 1990s and culminating in the global financial crisis. It came through them all with flying colors.

No economy, of course, is crisis-proof. But Australia’s has shown an impressive degree of resilience.

Why? After all, as 2007 began, the economy looked to be suffering from many of the same vulnerabilities as the rest of the English-speaking developed world. Like Americans and Brits, Australians let their spending run ahead of their incomes, and borrowed to make up the difference. And again, like Americans and Brits, Australians used some of that debt to buy houses, producing big increases in house prices—to the point that many observers were convinced the housing market was well overvalued. Yet while the U.S. and British economies came crashing down in a pile of financial debris, Australia’s economy continued to grow—largely thanks to good policy.

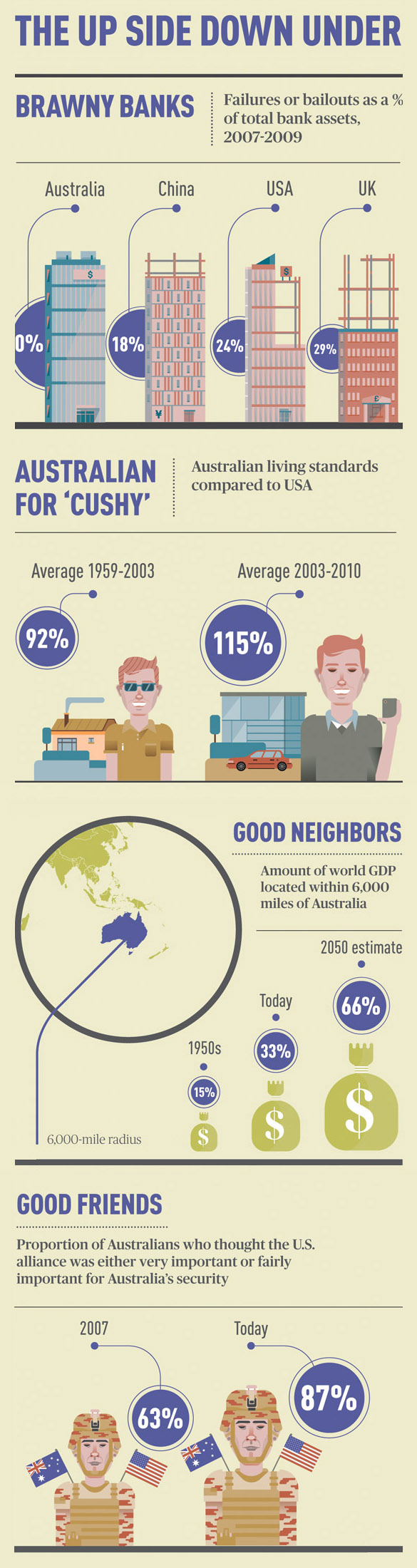

No major Australian bank failed during the crisis, and no taxpayer money was used to bail out any financial institution. In part, this was because banks tended to be conservatively supervised and regulated and conservatively managed. As a result, they mostly avoided taking the big bets and investing in the complex financial products that ended up blowing up many of their overseas counterparts. True, the government did have to step in and offer some support in the form of guarantees for borrowers and depositors. But set against other economies, it was pretty minimal intervention.

So the financial system continued to function normally, and that in turn meant that monetary policy was able to work as usual. There’s been no need for Australia’s central bank, the Reserve Bank of Australia, to experiment with driving interest rates down to zero or printing money like the Federal Reserve, the Bank of England, and Europe’s ECB. Instead, plain interest rate cuts (the RBA cut its main policy rate from 7.25 percent in September 2008 to 3 percent in April 2009) were able to work their old magic, delivering big decreases in interest payments for Australian borrowers.

And the federal government, in Canberra, was able to deploy fiscal firepower. Government initiatives included cash handouts to low- and middle-income households and an increase in investment spending. Although some of the details of these fiscal stimulus packages have since been the subject of domestic political criticism, international organizations such as the International Monetary Fund and the Organisation for Economic Co-Operation and Development have praised Canberra’s response.

Crucially, policymakers were able to be this aggressive without worrying about the consequences of running up large government debts, because in the six years before the global financial crisis, Australia had run budget surpluses of between 1 and 2 percent of GDP. Government saved in the good times to prepare for the bad, and as a result, net federal government debt on the eve of the crisis had been reduced to zero—in contrast to the large debt burdens hanging over governments in the United States, Europe, and Japan. That left Canberra with lots of fiscal space to play in.

Finally, Australia’s floating exchange rate has cushioned the economy from nasty shocks in the rest of the world in much the way economics textbooks say it should. In other words, the Australian dollar has weakened during times of stress, providing a competitive boost to exports, and strengthened during economic upturns, helping to cool any inflationary tendencies. In July 2008, on the eve of the financial crisis, the Australian dollar was worth about 98 U.S. cents and was almost as strong as it had ever been since 1983, when Australia first adopted a floating exchange rate. By October 2008, as the global outlook dimmed, it was worth just 65 U.S. cents. Then, as the economy recovered and the second round of the resource boom kicked in, it started to rise again. At the time of writing it was worth more than US$1.

(GRAPHIC: THE SURGERY)

AN UNPRECEDENTED RESOURCE BONANZA

From the early 1950s to around the mid-1980s, the price Australia received for its exports seemed to be in remorseless decline relative to the price it paid for its imports. As global economics shifted to an increasingly “weightless” shiny new tech boom, Australians worried that their boring, resource-based old economy was being left behind. Then gravity made a comeback.

For ten years, Australia has been enjoying the benefits of a once-in-a-century boom in the price of resources. And Australia has lots of resources. According to Geoscience Australia, the country has the world’s largest recoverable deposits of lead, silver, rutile, zircon, nickel, uranium, and zinc; the world’s second largest reserves of iron ore, bauxite, copper, gold, tantalum, and niobium; and the fifth largest reserves of black coal. Australia is currently the world’s largest exporter of iron ore and coking coal, and the second largest exporter of thermal coal.

Soaring prices for some exports, particularly iron ore, meant that by the second quarter of 2011, Australia’s ratio of export to import prices had surpassed its previous peak (in 1950–51, for wool, which was in demand during the Korean War) and reached its highest level in at least 140 years. By September 2011, the ratio had risen higher still, setting a new record.

While the biggest price gains have occurred in minerals, the price Australia receives for its exports of agricultural products has also risen sizably. And despite its future vulnerability to climate change and water stress, Australia remains a comfortably food-secure country, producing roughly twice the amount of food that it consumes.

All of which made the size, duration, and impact of this resource bonanza unprecedented.

Bob Gregory, professor emeritus of the Australian National University College of Business and Economics, has estimated that in the eight years since 2003, this increase in the terms of trade has lifted Australian living standards relative to those in the United States by 25 percent, taking them from a long-run average of around 92 percent of U.S. levels over the 1959–2003 period to about 115 percent of U.S. levels by 2010.

Past resource booms in Australia have tended to end in tears. Or, more accurately, in nasty, inflationary boom-bust cycles. This time, a policy framework that combines a floating exchange rate, an independent and inflation-targeting central bank, a strong fiscal position, and a more market-based wage-setting system than in those earlier cycles have so far combined to deliver a much more stable outcome. In particular, inflation has been kept firmly under control, and the economic overheating of past booms has largely been avoided. That same policy framework means Australia should be well placed to handle even some of the nastier scenarios now being talked about.

THE GIANT (MARKET) NEXT DOOR

Australia’s giant resource bonanza is, of course, part of a bigger story: the rapid industrialization and urbanization of Asia in general and of China in particular.

The past three decades have seen nearly 400 million Chinese—the population of about 20 Australias—make the transition from rural to urban life, according to Philip Lowe, deputy governor of the RBA. Another estimate puts the current urbanization rate across emerging Asia at about 44 million people each year, roughly double Australia’s population. All those new homes and apartment buildings and the infrastructure to service them require millions of tons of steel. All that steel requires millions of tons of iron ore and coal to produce it. Australia happens to have an awful lot of both.

By 2011, about 70 percent of all goods exports were headed to East Asia (mainly China, Japan, and South Korea), with a further 6 percent going to India. A decade ago, natural resources were 35 percent of Australia’s exports; they are more than 60 percent today, and most of them are sold to the country’s Asian trading partners. Economists at the IMF reckon that Australia’s exposure to these rapidly growing Asian markets could make the economy’s potential growth rate among the highest of the OECD economies.

The historian Geoffrey Blainey once wrote that “distance is as characteristic of Australia as mountains are of Switzerland.” For much of its modern history, Australia has had to contend with being a long way from where much of the (economic) action was taking place. In the 1950s, as much as 85 percent of world GDP was located more than 6,000 miles from Australia, and this distance imposed a significant economic handicap. But now that world production is shifting to Asia, Australia’s once disadvantageous location has become a boon. Today, more than one-third of world GDP falls within 6,000 miles of Australia. If emerging Asia keeps growing, as much as two-thirds of world GDP could be within the same reach by 2050.

THE PERILS OF PROSPERITY

In 1986, The Economist described Australia as “one of the best managers of adversity the world has seen—and the worst manager of prosperity.” Ever since, policymakers and commentators have periodically felt compelled to dust off that quotation. Lately, it’s been getting another outing.

A gap between the performance of the expanding resource sector and the rest of the economy has prompted Australians to fret about a “two-speed” or “patchwork” economy. In other words, while the resource sector has grown strongly, growth outside that sector has indeed been patchy, particularly in manufacturing and tourism. The high Australian dollar, high interest rates, and strong exchange rates squeezed this “other” economy.

A year after Australia’s terms of trade peaked, in September 2011, they had fallen about 14 percent. By the same time, iron ore prices had fallen to a three-year low, with many forecasters suggesting bigger price slides to come. Share prices for the big mining companies likewise dropped. How quickly might the mining boom unravel? Again, there are two different views. The pessimistic one is that a toxic combination of a permanent decline in Chinese demand and a big increase in mining supply prompted by all that new investment spending will trigger an abrupt and painful fall in commodity prices.

The more optimistic view—and the one still held by much of official Australia at the time of writing—is that the adjustment will turn out to be much more gradual. Sure, prices will come down from their record highs. But they will still remain comfortably above the painfully low levels of the 1980s and 1990s. Such forecasts assume that the 2012 slowdown in China is more temporary than permanent, and that Chinese demand will make a comeback; that rapid economic growth in other key parts of emerging Asia, like India, will eventually provide additional demand to offset any further decline in Chinese appetite; and that the gains Australia enjoyed from high prices will now be replaced by gains from a greater volume of exports at somewhat lower prices.

Which view is likely to be right? The optimists probably have the stronger analytical arguments on their side, and there are certainly good reasons for believing that in a world of rapidly industrializing and urbanizing Asian giants, resource prices are likely to find a higher equilibrium than in the past. For their part, the pessimists can justly point out that market corrections are rarely as smooth and gradual as official forecasts say: abrupt changes and big price moves are closer to the norm.

The answer to this question will have implications far beyond Australia. A high-priced, resource-constrained world economy would provide a very different international environment than a world economy that returned to the low commodity prices of the 1980s and 1990s.

LIFE BEYOND THE BOOM

Either way, more and more Australians agree that their country ought to be using the current period of prosperity to prepare for life after the resource boom.

In the coming years, it will be particularly important to ensure that Australia boosts the quality of education and training. By international standards, Australia already does well in this area—but it could do better. One of the most widely cited approaches for comparing international education standards is the Program for International Student Assessment, a worldwide study conducted by the OECD; it shows that although Australian students tend to score well above the OECD average for reading, mathematics, and science, the longer-term trend displays a worrying decline in achievement over the past decade—despite significant increases in spending on education.

For a typical advanced economy, productivity is the most important driver of the long-term standard of living. Productivity measures the efficiency with which an economy uses labor, capital, and raw materials to produce goods and services. Crudely put, economies can grow by getting more people into the workforce and giving those workers more capital, or by using workers and capital more efficiently.

Growth in labor productivity accounted for perhaps 90 percent of the growth in Australian average incomes over the 40 years to the start of the current century. It is worrying, then, that labor productivity is estimated to have fallen from a peak of nearly 92 percent of U.S. levels in the later 1990s to around 84 percent in 2010. As a result, in the 2000s, productivity growth has contributed only about half the growth in average incomes, with the boom in the terms of trade doing the rest of the work. There have been signs of an improvement in productivity growth over the past year, although it is still too soon to know if this marks a positive new trend. For now, productivity still represents an important qualification to Australia’s economic story.

This productivity slump could be temporary: it could, for example, reflect the impact of large investments in resources and utilities such as water and electricity, which have yet to pay off in terms of increased output. Or the slump could be the unavoidable downside of running the economy at close to full capacity, and thus a price worth paying: if much of the qualified workforce is already employed, adding new jobs for less qualified workers would likely only drag down overall efficiency.

Or the slump might reflect some of that complacency Australians are always being warned about.

CAUGHT BETWEEN WASHINGTON AND BEIJING

An important factor in future economic equilibrium is the relationship between Canberra’s most important security ally, the United States, and its most important trading partner, China.

Since Washington and Beijing are increasingly viewed as strategic rivals, Australian policymakers face a difficult trade-off: Do they cuddle up to their most important customer and risk alienating their security partner, or chance diminishing their economic welfare by sticking with their traditional ally? Writing about this dilemma has become a favorite occupation for Australia’s foreign policy strategists.

In 2011, China accounted for almost one-quarter of all Australian goods trade. In the same year, polling by the Lowy Institute for International Policy in Sydney found that about 75 percent of those asked agreed that China’s growth had been good for Australia. A 2012 poll found that the Australian public is even inclined to give China rather more credit than Australia’s own policies for weathering the global financial crisis.

This recognition of China’s economic importance does not mean that Australia is looking to throw old relationships aside. Quite the contrary. For all the good economic news, Australian voters remain ambivalent about Australia-China ties, skeptical about the benefits of Chinese investment in Australia, and concerned about the longer-term implications of China’s rise for the future of the region. Lowy Institute polling shows Australians becoming more, not less, attached to the U.S. alliance, even as their economy has grown more entangled with China’s. According to its 2012 poll, 87 percent of those asked thought that the U.S. alliance was either very important or fairly important for Australia’s security—up from 63 percent in 2007. Prime Minister Julia Gillard’s speech to the U.S. Congress in March 2011 was explicit in setting out Australia’s continued commitment to the U.S. alliance, with Gillard declaring Australia “an ally for the 60 years past and … an ally for all the years to come.” Similar declarations accompanied the visit of President Obama to Australia eight months later, when Obama said that Americans and Australians have “got each other’s backs.”

For its part, Beijing has been disappointed by the rather cautious welcome Australia gives Chinese companies, and the way in which the strategic relationship has lagged the economic one.

Australia’s official line, developed under Prime Minister John Howard and largely reiterated by his successors, is that it sees no inherent reason it cannot continue to enjoy both its traditional relationship with the United States and its rapidly deepening economic ties with China. Whether it can successfully continue this juggling act is a question with resonance for a range of other regional economies.

Playing to the country’s strengths, investing in its people, avoiding complacency, managing the three-way relationship with Washington and Beijing and, hopefully, a continued bit of good luck—this should all ensure that Australia’s good start to the current century is sustained beyond its opening decades. And it should make the Australian model one that’s still worth paying attention to.

This article appeared in print under the title “Island in the Sun.”