In recent years, the concept of a universal basic income (UBI)—governments providing every single citizen with a cash transfer sufficient to ensure a minimum standard of living—has gained a diverse following in countries around the world. The concept is particularly popular among those concerned about the effects of technology and automation on employment. In fact, Y Combinator, a Silicon Valley start-up incubator, is currently funding a randomized, controlled trial of a UBI in two states.

“One reason we think it may work is that technological improvements should generate an abundance of resources,” wrote Y Combinator president Sam Altman in a blog post announcing the experiment. “Although basic income seems fiscally challenging today, in a world where technology replaces existing jobs and basic income becomes necessary, technological improvements should generate an abundance of resources and the cost of living should fall dramatically.”

In a new working paper, economists Hilary W. Hoynes and Jesse Rothstein, both of whom have extensively studied the social safety net in America, take a look at the costs, distributional effects, and possible labor-market effects of UBI programs in advanced economies with existing social safety nets. They find, in line with many of the most prominent criticisms of the UBI, that such programs, if they were truly universal, would indeed be very expensive and, in comparison to the existing social safety net, would likely redirect spending to better-off families, potentially leaving low-income families worse off than they currently are.

The researchers start by calculating the cost of a UBI in the United States. They estimate that providing a $12,000 payment—approximately equivalent to the poverty line for a single adult—to every U.S. adult over the age of 18 would cost about $3 trillion per year. This is, to put it simply, an enormous sum.

“This is about 75 percent of current total federal expenditures, including all on- and off-budget items,” the researchers conclude. “Thus, implementing this UBI without cuts to other programs would require nearly doubling federal tax revenue.”

Hoynes and Rothstein note that even cutting all existing transfer programs—like food stamps, welfare, and the Earned Income Tax Credit—which account for half of federal expenditures, would make only a dent in the cost of a UBI.

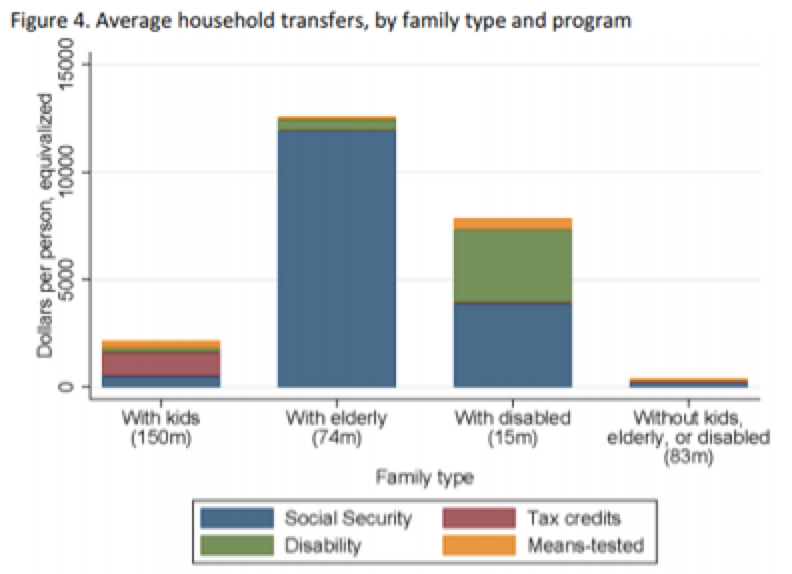

If a UBI in the U.S. were to replace other safety net programs, as some have proposed, such a program would also result in a big distributional shift. This chart, from the paper, illustrates the current distribution of federal safety net spending, by family type:

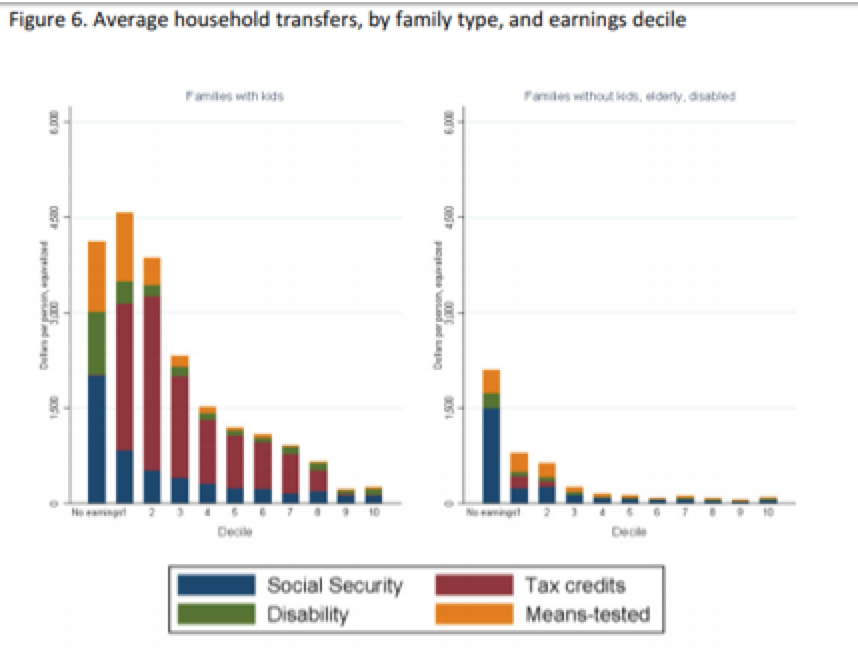

Current U.S. safety net spending is also heavily targeted to lower-income families, as the chart below, also from the paper, makes clear:

Replacing all current U.S. safety net programs, including those aimed at senior citizens, with a truly universal basic income would result in “a massive distribution up the earnings distribution, along with a redistribution from the elderly and disabled towards those who are neither, primarily but not exclusively those without children.”

The elderly, in particular, would lose out—the average U.S. senior currently receives $17,400 in Social Security and about $12,900 in in-kind Medicaid and Medicare benefits. Preserving Social Security, Medicare, and Medicaid would, of course, enable the elderly to maintain their standards of living, but eliminating the rest of the social safety net programs—the EITC, Temporary Assistance for Needy Families, the Supplemental Nutrition Assistance Program, etc.—would cover only about 20 percent of the cost of a UBI. (While the exact calculations are specific to the U.S., the authors note that their conclusions are generalizable to other advanced economies.)

The labor market effects of a UBI are a bit more complicated to assess. The researchers conclude that providing every citizen an income would likely lower labor supply in the short run but may, as advocates argue, encourage some recipients to seek out additional training or education. The researchers also point out that it might improve educational and labor market outcomes for the children of recipients.

This latter effect is a particularly important one as a substantial body of research confirms that increasing family resources during early childhood improves outcomes for children. Researchers have found that U.S. children whose mothers participated in a cash-transfer program during the early part of the 20th century lived longer, obtained more schooling, and had higher earnings in adulthood than children whose mothers were rejected from the program.

Hoynes (with co-authors Diane Whitmore Schanzenbach and Douglas Almond) has demonstrated that childhood access to nutritional assistance (i.e., food stamps) leads to better health in adulthood and improved economic outcomes for women. Likewise, researchers, including Hoynes, have found that the EITC improves both infant health and children’s educational outcomes. Similarly, economists who studied an unconditional-cash-transfer program, funded by casino profits, among a Native American tribe have found that children whose families received the payments exhibited better educational and behavioral health outcomes and lower incidences of arrests, and that the effects were largest for the poorest families.

Indeed, one of the most compelling arguments against a UBI to emerge from this paper may be that, at the most likely funding levels, it would redistribute resources away from low-income families with children. As the first chart above illustrates, families with children already seem to be a low priority in the U.S., despite strong evidence that investing in early childhood is sound policy.