One conventional explanation for our economic problems seems to be that our businesses are strapped for funds. Greater business earnings, it is said, will translate into needed investment, employment, consumption, and, finally, sustained economic recovery. Thus, the preferred policy response: Provide business with greater regulatory freedom and relief from high taxes and wages.

It is this view that underpins current business and government support for new corporate tax cuts and trade agreements designed to reduce government regulation of business activity, attacks on unions, and opposition to extending unemployment benefits and increasing the minimum wage.

One problem with this story is that businesses are already swimming in money and they haven’t shown the slightest inclination to use their funds for investment or employment.

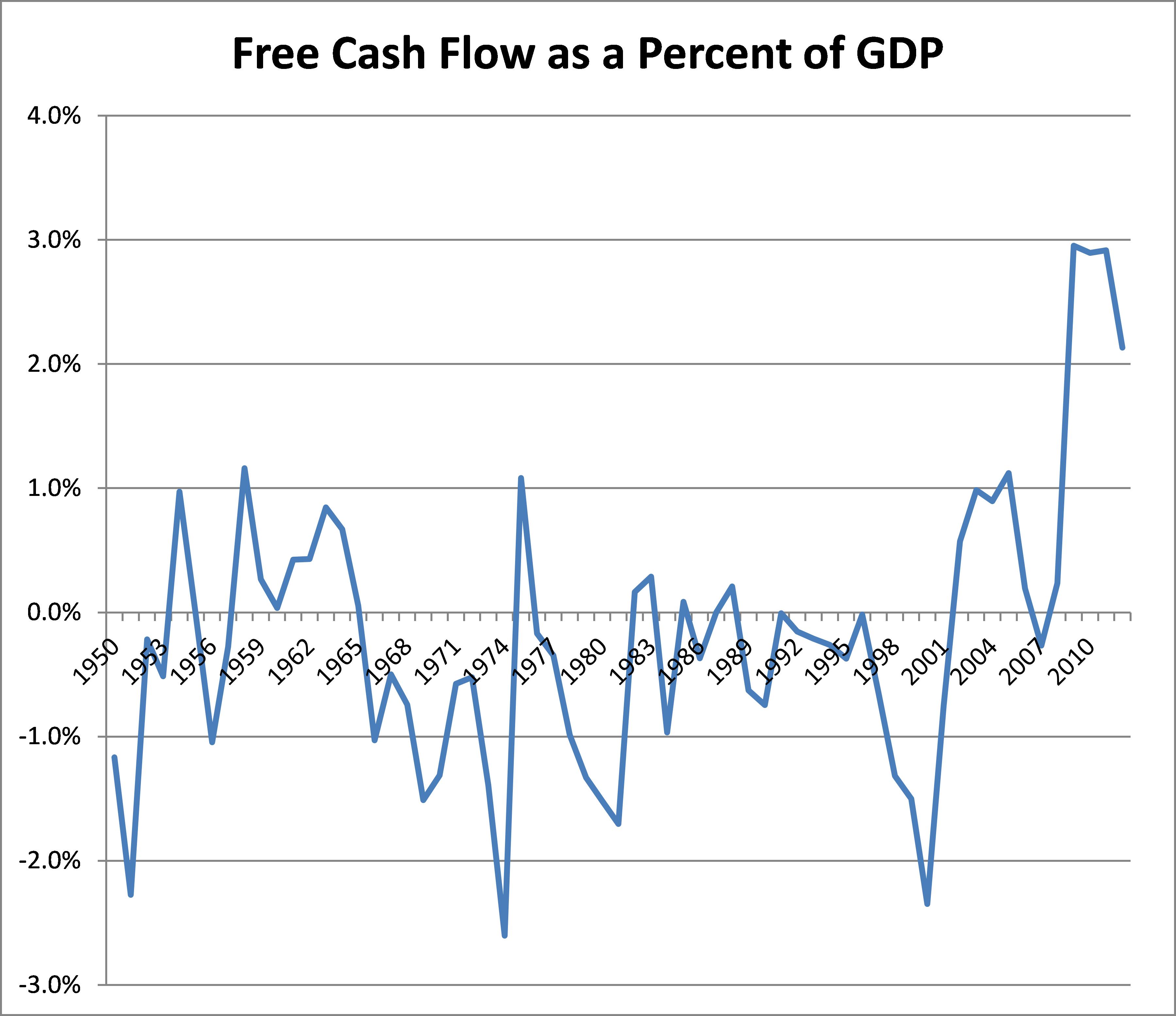

The first chart below highlights the trend in free cash flow as a percentage of GDP. Free cash flow is one way to represent business profits. More specifically, it is a pretax measure of the money firms have after spending on wages and salaries, depreciation charges, amortization of past loans, and new investment. As you can see, that ratio remains at historic highs. In short, business is certainly not short of money.

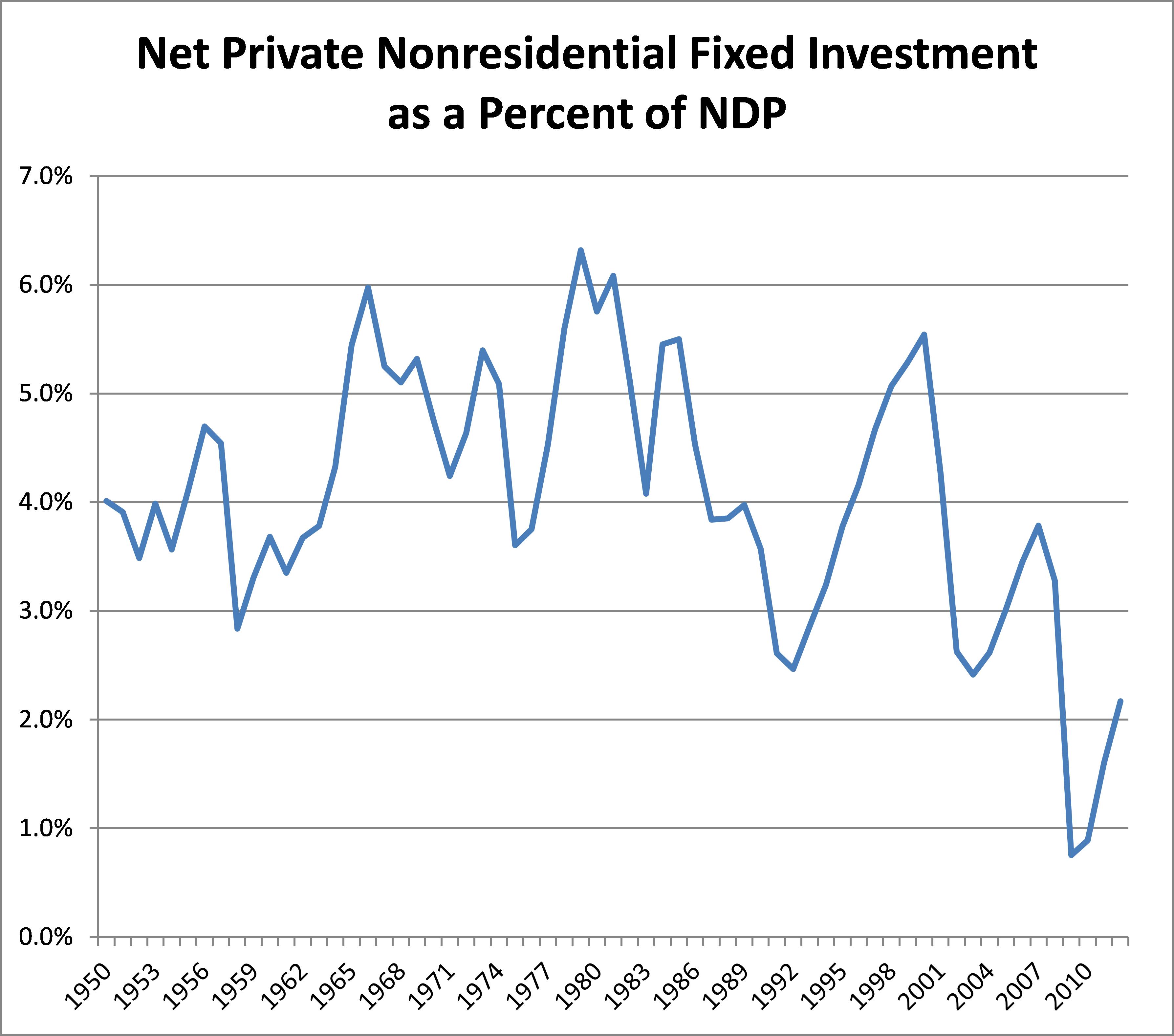

So what are businesses doing with their funds? The next chart looks at the ratio of net private non-residential fixed investment to net domestic product (I use “net” rather than “gross” variables in order to focus on investment that goes beyond simply replacing worn out plants and equipment). The ratio makes clear that one reason for the large cash flow is that businesses are not committed to new investment. Indeed quite the opposite is true.

Rather than invest in plants and equipment, businesses are primarily using their funds to repurchase their own stocks in order to boost management earnings and ward off hostile take-overs, pay dividends to stockholders, and accumulate large cash and bond holdings.

Cutting taxes, deregulation, attacking unions, and slashing social programs will only intensify these very trends. Time for a new understanding of our problems and a very new response to them.

This post originally appeared on Sociological Images, a Pacific Standard partner site.