Any improvement in living and working conditions in the United States is going to require far more than tinkering at the margins. The fact is that U.S. economic dynamics have undergone a major transformation.

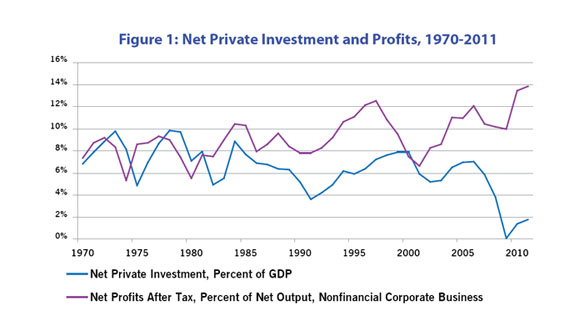

Figure 1, taken from an article by Gerald Friedman, shows that profits and investment are no longer positively related. Since the early 2000s, profits have soared as a percent of GDP and net private investment has plummeted. Even during the 1990s, when high-technology was celebrated as the engine of never-ending growth, net investment as a share of GDP remained below 1970s and 1980s highs.

Our leading companies, the ones that shape government policy, are now able to make healthy profits without spending on plant and equipment much beyond replacement. Their profits are now largely secured by globalizing manufacturing production, financialization, intensification of work, wage suppression, and government tax-breaks and subsidies. Of course, that means that their quest for profits will continue to lead to policies likely to undermine progress in reversing negative trends in majority living and working conditions.

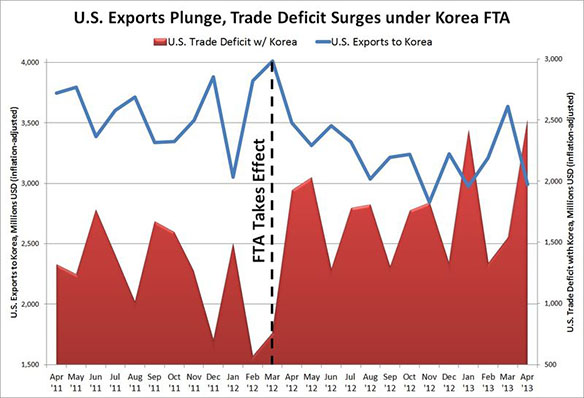

A case in point is their aggressive push, supported by the Obama administration, for new free trade agreements: the Trans-Pacific Partnership Free Trade Agreement and the Trans-Atlantic Free Trade Agreement. President Obama took the lead in securing passage of the Korea-U.S. Free Trade Agreement, arguing that it would improve our trade balance with Korea and by extension U.S. jobs. Well, the returns are in, and in line with the record of past agreements, the outcome is the exact opposite.

The Eyes on Trade blog offers the following summary:

April [2013] was another record-breaking month for U.S. trade with Korea under the U.S.-Korea Free Trade Agreement (FTA). The monthly U.S. trade deficit with Korea soared to its highest point in history, topping $2.5 billion for the month of April alone.

According to a ratio used by the Obama administration, the unprecedented deficit surge implies 13,500 U.S. jobs lost to trade with Korea in just thirty days. April’s trade deficit with Korea was 30% higher than in April 2012 — the first full month of FTA implementation — and 90% higher than in April 2011, before the FTA took effect.

The deficit increase owes largely to a dramatic drop in U.S. exports to Korea since enactment of the FTA. U.S. exports to Korea in April once again fell below the levels seen in any given month in the year before the FTA took effect. The sorry track record defies the promise (FTA = more exports) that the Obama administration used to pass the FTA. Undeterred by the facts, today the administration is using the same worn-out promise to sell the Trans-Pacific Partnership.

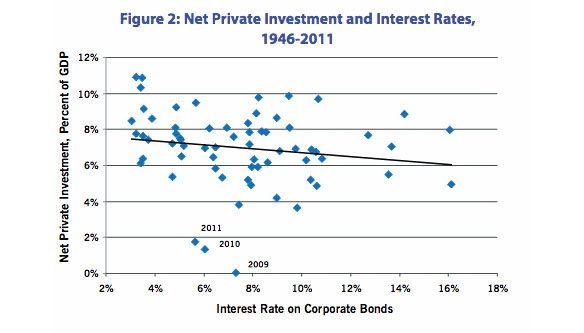

Unwilling to pursue policies that directly threaten corporate interests, the Obama administration has relied on monetary policy, or more specifically lower interest rates, to boost investment and employment. As Figure 2 from Friedman’s article makes clear, while lower rates generally boost investment, data points for 2009, 2010, and 2011 strongly suggest that monetary policy has lost its effectiveness.

President Obama can talk all he wants about the need for more investment and better jobs, but unless he is pushed to pursue dramatically different policies, it is hard to see any real gains for working people over the next decades.

This post originally appeared onSociological Images, a Pacific Standard partner site.