When a bank moves to foreclose on somebody approaching retirement, it doesn’t just threaten to rip away their home, their pride, and their nest egg. It can strip them of their will to live.

A rise in suicide rates in recent years coincided with the nation’s economic depression. Those most affected have been living what should have been the middles of their lives. Suicide rates jumped by nearly a third among middle-aged Americans from 1999 to 2010, overtaking the high suicide rate among the elderly.

Suicide rates weren’t the only thing surging upward as the economy spiraled downward. There were a record-breaking 2.9 million foreclosures in 2010, about one out of every 50 homes in the United States, up from 650,000 in 2007.

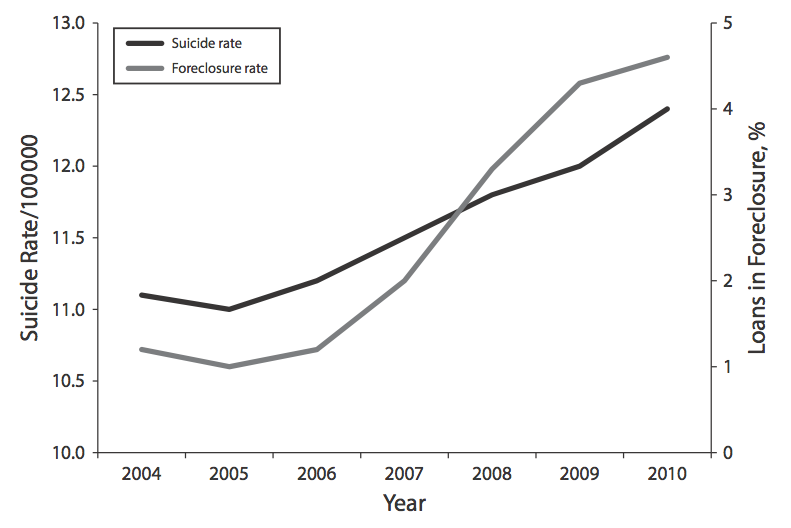

A pair of researchers, from the University of Wisconsin-Madison and Purdue University, wanted to figure out whether there was any relationship between suicide rates and home foreclosures. Judging by a quick glance at the data that they analyzed, there would seem to be such a relationship:

(Chart: American Journal of Public Health)

But this graph alone cannot be trusted—confounding factors abound. To search for relationships between foreclosure and suicide rates, the researchers controlled for certain variables like the unemployment rate, and then honed in on intrastate data.

“This nets out all stable between-state differences, allows us to use a state as its own control, and basically allows us to examine, on average, how within-state changes in the foreclosure rate are associated with within-state changes in the suicide rate,” says Dartmouth College Assistant Professor of Sociology Jason Houle, one of the authors of the new study, which will be published next month in the American Journal of Public Health.

These steps led the researchers to a grim discovery—one that implicates banks’ irresponsible lending practices in more than just the death of middle-class prosperity.

“Our results suggest that the foreclosure crisis significantly contributed to the increase in suicides in the Great Recession,” the researchers write in their paper.

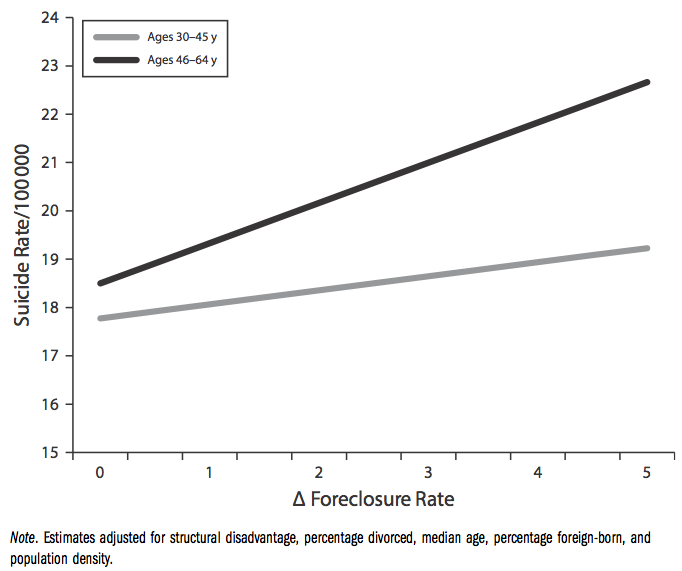

A statistically significant within-state foreclosure effect on suicide rates was detected between 2005 and 2010 for two age groups studied—30- to 45-year-olds, and 46- to 64-year-olds. The effect for 30- to 45-year-olds was small. It was vast for those who were still of working age but approaching retirement, helping explain the 18 percent suicide rate among 46- to 64-year-olds.

(Chart: American Journal of Public Health)

Houle says the findings help explain the puzzling rise in middle-aged suicide rates in a recession-wrecked nation.

“These folks are more likely than most other age groups to have mortgages,” Houle says. “This is an age group that’s gearing up for retirement. A foreclosure, or even a loss of equity in their home, could be financially devastating—without very much time to recover financially.”