When facing a medical emergency, few patients pause to consider whether the emergency room they end up in, or the doctors providing their care, are in their health insurance plan’s network. A new analysis from the Kaiser Family Foundation suggests patients pay a steep price when they’re not able to consider that variable.

Most private insurance plans strongly prefer that enrollees use providers within the plan’s established network of providers. To encourage this, insurers typically cover a much higher percentage of the care provided by within-network providers; insurers are also required, under the Affordable Care Act, to limit annual cost-sharing payments for care provided by in-network providers. By contrast, enrollees who receive care from providers outside their plan’s network are often hit with very high out-of-pocket costs. This issue has received quite a bit of attention in recent years, with patients sharing horror stories of surprise bills for care provided by out-of-network providers they barely interacted with at in-network facilities.

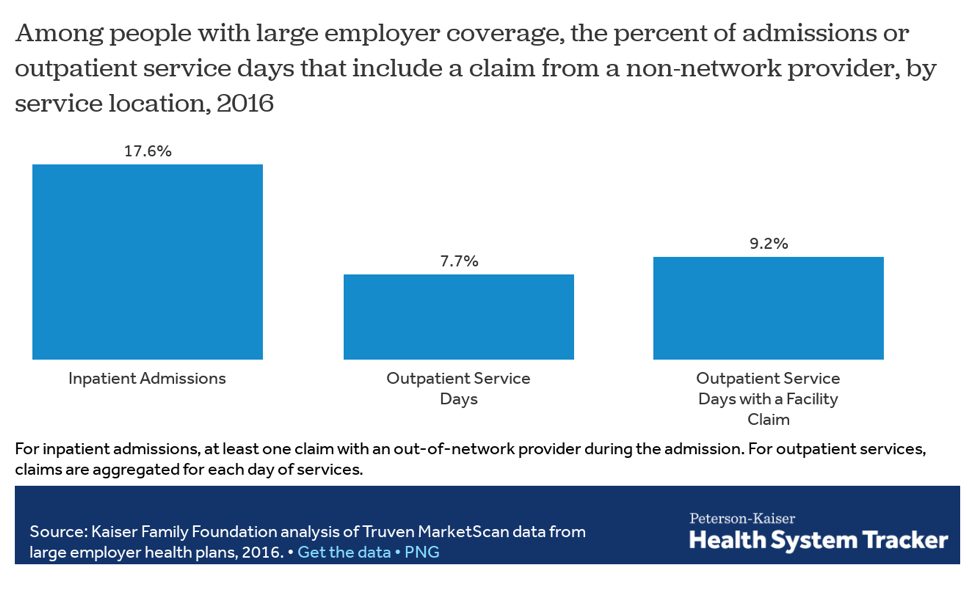

In a new analysis, Kaiser Family Foundation researchers Gary Claxton, Matthew Rae, Cynthia Cox, and Larry Levitt examine the prevalence of out-of-network claims among large employer-sponsored plans. As the chart below, from the report, illustrates, out-of-network claims resulting from both inpatient and outpatient hospital stays are common:

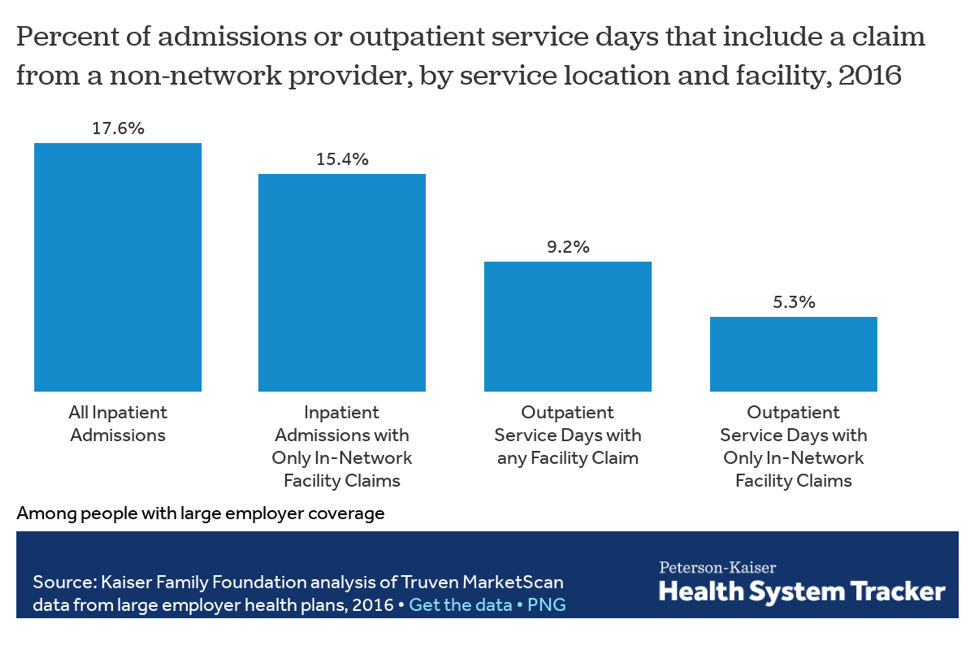

Over 17 percent of inpatient hospital stays resulted in at least one out-of-network claim, while over 7 percent of outpatient hospital “service days” resulted in an out-of-network claim. And even patients at in-network facilities can face these claims. As the chart below shows, 15.4 percent of inpatient admissions at an in-network facility resulted in at least one out-of-network claim:

The problem is particularly pronounced among inpatient admissions that included an emergency room claim. Approximately 27 percent of inpatient admissions with an emergency room claim included at least one out-of-network claim (in comparison to about 15 percent of those without an emergency room claim), and 24.7 percent of admissions at in-network facilities including an emergency room claim included at least one out-of-network claim. As the authors note, patients in emergency situations “have limited ability to control the care they receive and from whom they receive it. Even when the facility is in-network, the professional services may not be and the patient often is not in a position to direct their care.” In a study published in 2016, researchers found that out-of-network emergency room doctors were paid over 2.5 times what in-network doctors were (for the same services).

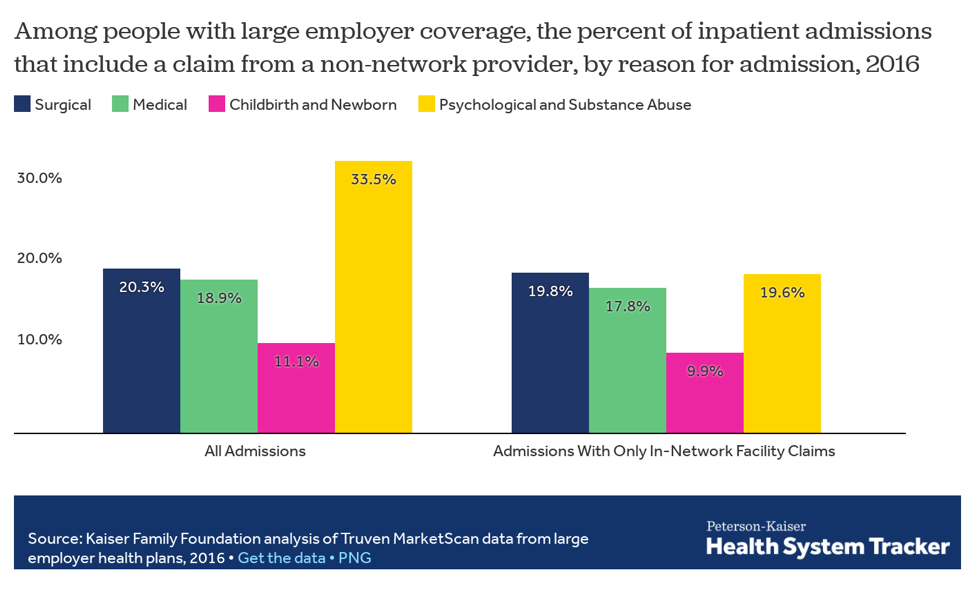

Out-of-network claims are also particularly prevalent for mental-health services, as the chart below illustrates:

A whopping 33.5 percent of inpatient admissions (for psychological or substance abuse issues) included at least one out-of-network claim. The authors write that “[t]hese high rates raise questions about the availability of services within plan networks, and perhaps of the quality of the network providers.”

Policymakers at both the state and federal level have taken steps to protect patients from these surprise bills, but this Kaiser Family Foundation report suggests more work remains.