The Trump administration’s promises to revive the coal industry and reinvigorate the fossil fuel industry more broadly are not the only things standing in the way of renewable energy. A new report released today from the Democratic staff of the Joint Economic Committee outlines several market and policy barriers:

1. Subsidies Keep Fossil Fuel Prices Below Their True Cost

The price of renewable energy has been falling, and wind and solar are even cheaper than fossil fuels in some parts of the country, but the fossil fuel industry continues to benefit from billions of dollars in government subsidies, helping to ensure lower prices for fossil fuels. The market prices of fossil fuels often don’t take into account their indirect costs, such as the cost of cleaning up an oil spill or the health costs related to air pollution.

2. A Lack of Funding for Clean Energy Research

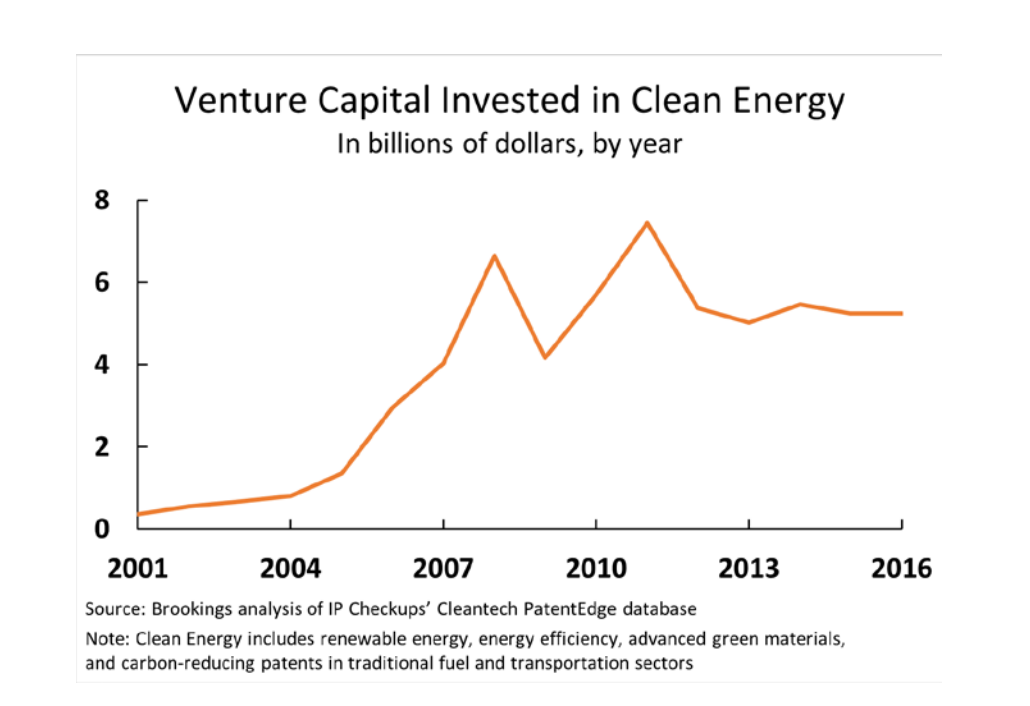

The private sector typically builds off of federally funded research to develop marketable products, which means it’s partly up to the government to get the ball rolling on any technological innovation in the renewables sphere. But for the past few years, the budget for government-funded research has continually been slashed. Between 2011 and 2015, the non-defense research budget fell by $6 billion. Meanwhile, its harder for clean energy to get venture capital investments because, as the report states, “Compared to other advanced industries, energy technologies typically require more capital, take longer to reach market, and have fewer ways for investors to monetize their early investment stakes.” Venture capital funding for renewables fell by 30 percent between 2011 and 2016.

(Chart: Brookings Institution)

3. Energy Infrastructure Is Built for Fossil Fuels

Most renewable energy is produced farther away from metropolitan areas, which makes it harder to integrate into existing systems. New technologies to store and transmit energy often have to be developed, and rate structures have to be updated to account for different energy sources.

4. America’s Clean Energy Companies Are at a Disadvantage to International Ones

The global clean energy market already tops $1.35 trillion, and shows no signs of slowing down. Many countries now invest more than the United States in the manufacturing of renewable technologies like solar cells and batteries. China has emerged as one of the U.S.’s foremost competitors on this front; Beijing announced in January it would be investing $360 billion in alternative energy by the close of this decade.

5. Policy Uncertainty Discourages Investment

President Donald Trump’s decision to withdraw from the Paris Agreement and his administration’s proposal to make significant cuts to the Department of Energy’s renewable and energy efficiency program threaten to further undermine investments in renewables. The renewable industry receives federal subsidies of its own, for example, which are set to expire within the next six years.

It’s unclear what will happen to the renewable industry in the coming years, under a president who has called the technologies just “an expensive way of making the tree-huggers feel good about themselves.” But if the past is any indication of the future, when the Production Tax Credit—a federal subsidy for new renewable projects—expired in 2012, in the year before it was finally renewed by Congress, new wind projects fell by 92 percent.