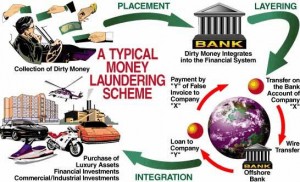

A few hours ago, the wires broke that Hongkong and Shanghai Banking Corporation (HSBC), one of the world’s largest financial institutions, will pay a record $1.9 billion for its involvement in money laundering. How does a bank not quite detect that various narcotics and mafia organizations are doing business in the broad daylight of its accounts?

A 2010 study by the International Monetary Fund’s Financial Action Task Force looked at the problem, and reached the deflating observation that banks are just so useful to criminals, and so unable to track their own products, that noticing laundering even when it’s obvious proves tough.

The FATF’s list of traditional banking’s upside for criminals reads like a pitch for a retail checking account:

Bank transfers allow value to be moved electronically and relatively quickly in a relatively highly regulated environment. It is a high volume activity, with millions of legitimate transactions taking place globally each day across thousands of banks, involving an even greater number of counterparties. Access to the banking system can be over the counter, or by using the internet or telephone, by the owner of the funds or by instructed third parties, such as lawyers, accountants or private bankers.

Sounds good. For the Zeta on-the-go hauling an old gym bag filled with $4.2 million in mixed Dollars, Euros and Pesos, what’s not to like? Even post-9/11 banking rules make it hard for a sprawling financial world to detect criminal patterns, claims the IMF study. Particularly in places with corruption:

The abuse of the banking sector is enabled by factors such as the sheer size and scope of the global financial sector, complexity of banking arrangements and products which allows concealment. Banking systems in those jurisdictions with weak preventive measures also enable the abuse of this sub-feature.

Further down, though, the study starts to sound a little apologetic. Banks have trouble checking ID’s, apparently. What?

The abuse of the banking system is often also enabled by the use of false or stolen identities which are used to avoid being identified through application of CDD requirements or to gain access to accounts….Another enabler is the possibility of transferring the right to access bank/deposit accounts to third parties. In some cases access to an account may be granted to a third party upon presentation of the account holder’s details (account number, name of the account holder), an identification document and the power-of-attorney.

To say nothing of the internet, where no one knows you’re a narco-trafficer. Should a bank call to verify a client’s details — before processing those curiously clockwork cash deposits of exactly $9,999 made at precisely 5:03pm every third Thursday — it’s often tough to reach that particular customer, says the IMF:

Customers’ ability to remotely access deposited funds means that illegal funds integrated into the banking system can be managed without the physical presence of the account owner, through a bank-customer system (operated via the internet or telephone) from virtually any place of the world. When a bank’s internal control service detects a suspicious transaction, getting in touch with the customer to clarify the nature and goal of the transaction may be difficult. The bank’s customer, being physically far away from the bank, may continue to conduct the suspicious transactions remotely before access is eventually discontinued.

Eventually.

Apologies for the excessive snark, but here at the 101 we too boast at least one HSBC customer, and this news is pretty annoying. HSBC will flag a debit card for a security grilling if you so much as change your breakfast order three days in a row. Launder $37,000 in South African Rand by wire transfer via Macau, though — no problem! Well, now it’s a problem. Two billion worth.