Last month, researchers at the University of Texas–Austin released a report alleging price distortion in a prominent financial index. Titled “Manipulation in the VIX?,” the paper flagged trading patterns that could indicate wrongdoing.

The index in question, called the VIX Volatility Index, tracks the volatility of S&P 500 options, which are contracts giving the holder the right to buy shares of a stock. In other words, the VIX acts as a barometer for investor expectations that stock markets will move down or up.

When market conditions become less certain, VIX shares go up in value, and vice versa. This is one marker journalists turn to when they’re looking for a measure of investor confidence; as the index’s owner Chicago Board Options Exchange boasted in a white paper released in 2014, “It is regularly featured in the Wall Street Journal, Barron’s and other leading financial publications, as well as business news shows on CNBC, BloombergTV and CNN/Money, where VIX is often referred to as the ‘fear index.'”

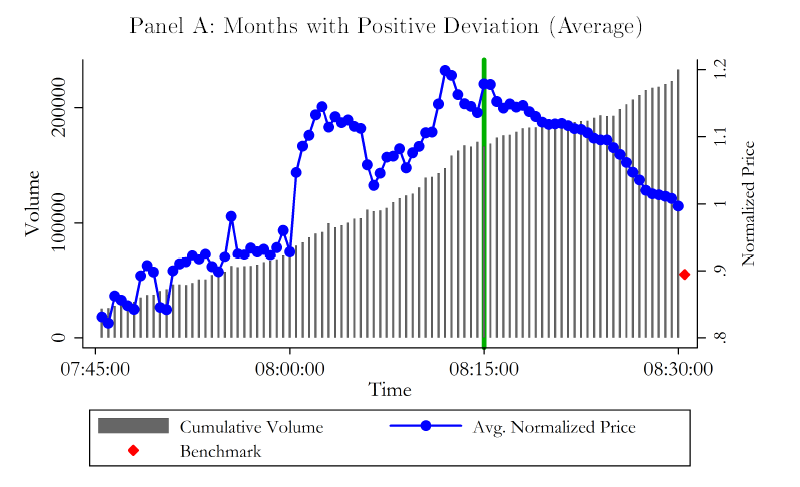

But researchers John Griffin and Amin Shams claim this fear index is helping market manipulators cash out, namely through a process that involves first buying the VIX, then submitting aggressive buy orders to stir up interest in S&P options in order to raise VIX prices.

Their paper indicates that, much like a salesman putting his thumb on the scale, investors can trade one type of investment to make another more valuable. Then, they’re able to get a higher price when they sell. That’s great for buyers, but it hurts the market by artificially moving prices away from the free market consensus and costing sellers extra. “These findings highlight a sizeable wealth transfer taking place from the investors on one side of trades in the VIX derivatives to the other,” the researchers write, pegging the distortion caused by this manipulation at $1.95 billion.

(Chart: John Griffin & Amin Shams)

CBOE disputes the researchers’ claims, saying that their “conclusions are based upon fundamental misunderstandings about how VIX derivatives are traded and settled.”

“All of the trading behavior that he considers suspicious is entirely consistent with normal and legitimate trading behavior and is not evidence of manipulation,” a company spokesperson writes to Pacific Standard in an email, adding that CBOE’s own regulatory program watches for wrongdoing with more comprehensive data than academic researchers have access to. Some analysts have also attributed the observations to normal portfolio management. In the view of some, spiking trade volume just represents traders managing risk by replacing one type of investment with another. The researchers count this explanation as unlikely in their paper.

At this point, Griffin and Shams’ research only raises questions, namely the potential for costly market distortion to the benefit of savvy investors. But it’s striking that a potential trend with such costly implications only came to light 24 years after the index was introduced.

“What was amazing about this manipulation was that it had gone on for so long, even evading the people who regularly traded these companies.”

In theory, the Securities and Exchange Commission oversees markets and watches for these kinds of patterns. However, the SEC is, by some measures, chronically underfunded, with budgets below what both the president and the Senate Appropriations Committee requested for five years in a row. It also faces the challenge of pulling the best and brightest away from the promise of massive rewards on Wall Street. As a result, we end up with a patchwork approach to regulative detective work that often involves academic research.

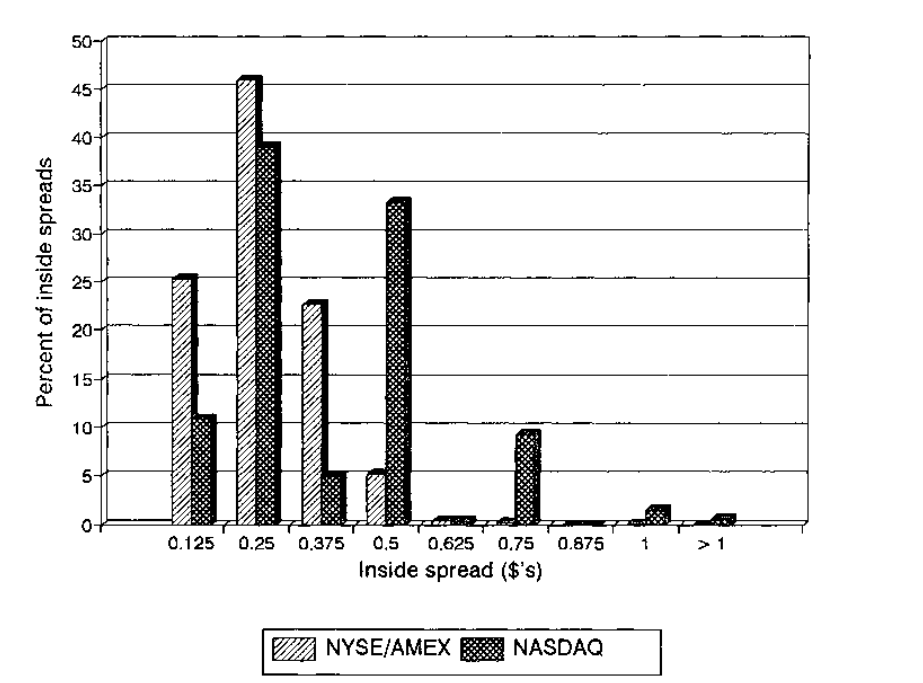

That means suspicions of manipulation often pop up out of sheer luck. This was the case in the mid-1990s, when two professors found evidence of collusion in the Nasdaq, the stock market that lists such high-tech companies as Apple and Microsoft.

“We were not looking for any type of price manipulation at all when we came across it,” says Bill Christie, one of the researchers, who is now a professor of finance at Vanderbilt University. “What was amazing about this manipulation was that it had gone on for so long, even evading the people who regularly traded these companies.”

In this instance, brokers were widening the spread between buying and selling prices by only quoting stocks in certain fractions of a dollar—25 cents versus 12.5 cents, for example. After significant industry pushback, the research sparked a $910 million class-action lawsuit, government investigations, and market reform. But even a case that ends in reform doesn’t fix the market for good: A follow-up from The Economist raised concerns about further price manipulation at smaller amounts.

“The next person’s thinking about, ‘How can I get around the rules that have just been enacted?'” Christie says.

Whether or not manipulation has occurred in the VIX has yet to be determined. Regulators haven’t taken any action, and there is a reasonable explanation for the behavior in question. As these cases demonstrate, though, markets are complicated. Investigating them requires a lot of time, energy, and attention directed in the right place, leaving room for all sorts of bad behavior.

“There is so much money at stake,” Christie says. “If you can find a way to get a fraction of what’s traded every day, apparently whether legal or illegal, someone will try to take advantage of it.”