Consumers love saving money using drug copay coupons. But by upending the benefit structure of health insurers, these clever marketing tools may be increasing costs for everyone.

By Charles Ornstein

(Photo: Luke Sharrett/Bloomberg via Getty Images)

A few months back, after returning from a family vacation that involved lots of pool time, my nine-year-old son complained that his ear hurt. A Sunday morning trip to urgent care brought a diagnosis of swimmer’s ear — an infection of the outer ear canal — and a prescription for ear drops.

When my wife went to fill the prescription, for a quarter of an ounce, she was told that our share of the cost would be $135.

Even with the increasingly high cost of drugs, that seemed like a lot. Since I’m a longtime health-care reporter, my wife asked me what to do. “Fill it,” I said, thinking more like a father than a journalist.

Wisely, she didn’t listen. Instead, she searched online for a coupon for the brand-name drug the doctor had prescribed, Ciprodex. She pulled one up on her phone, showed it to the pharmacist and sliced our cost by more than half, to $60.

That was great for us. Like most consumers, we were practically giddy about the savings. But such coupons have hidden effects on health-care costs that most of us don’t ponder.

Drug coupons are a clever marketing tactic increasingly used by pharmaceutical companies for a counterintuitive purpose: to keep drug prices high. By forgoing or reducing patients’ payments for pricier brand-name drugs, they ensure more sales for which insurers foot the bulk of the bill. (The companies get nothing if people choose generics or don’t fill prescriptions at all.) The coupons also stymie insurers’ attempts to encourage consumers to factor price into their health-care decisions. And by making the true cost of a drug essentially unknowable, they are yet another example of how medical pricing remains opaque, despite the promise of the Affordable Care Act.

Critics say the coupons encourage patients to use brand-name products when cheaper alternatives may be available — and that raises costs and co-payments for everyone.

In essence, it’s a war between two big industries trying to maximize their bottom lines: insurers vs. drug manufacturers. Patients, who often have no clue which drug is best, are stuck in the middle. They definitely enjoy getting what seems like a deal — but in the long run, the coupons help keep health-care costs rising.

The virtues and drawbacks of coupons have been thoroughly debated by health-policy wonks for the past few years as they have surged in popularity. Supporters say that insurance companies and pharmacy benefit managers have been jacking up co-pays in pursuit of profits and that lower prices increase the odds that patients will take the medicine they need. Critics say the coupons encourage patients to use brand-name products when cheaper alternatives may be available — and that raises costs, premiums, and co-payments for everyone.

Coupons have another little-noticed effect. While health plans increasingly rely on deductibles to control rapidly rising drug costs, coupons are just as rapidly undermining them — which, in another paradox, could wind up driving them even higher.

Deductibles require consumers to pay a certain amount before their insurers start covering costs. Of the $135 our pharmacy initially wanted for Ciprodex, $100 was to cover my son’s annual drug deductible, and $35 was the standard co-payment for a brand-name drug. With the coupon, we paid only $60 for the prescription. Still, my pharmacy benefit manager (which manages drug coverage for my insurance company) credited us with spending the entire $135, so we skipped right through the deductible.

“It’s kind of like a get-out-of-jail-free card,” said Joseph Ross, an associate professor at the Yale School of Medicine.

Others have had similar experiences. Dave McCulloch, 32, has used coupons from Gilead Sciences to fully cover his out-of-pocket costs for Truvada, an expensive drug that prevents HIV infection for groups at high risk. (The drug is effective both at treating HIV and preventing it.) When he filled his prescription for the first time in March, McCulloch later discovered that his pharmacy benefit manager credited him with paying $350 when he’d actually paid nothing. His insurer, CareFirst, “has no idea that Gilead paid that amount instead of me,” McCulloch said in an email.

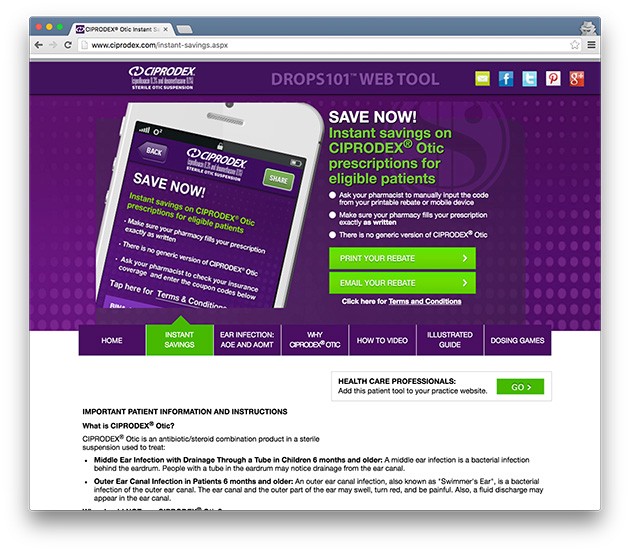

A screenshot of Ciprodex’s instant savings website.

When patients can meet their deductibles with a pharmaceutical company’s money, as McCulloch and I both did, they have less reason to pay attention to how much money they’re spending on health care — which, in theory, the deductible and co-payments are supposed to make them do. That means prices can continue rising, pushing insurers to raise premiums, deductibles, and copayments in response.

Figures from IMS Health, a health information company that purchases data from pharmacies and sells it to pharmaceutical companies and others, show that the use of co-pay coupons has surged since 2010 across 11 drug classes, including some in which medications are especially costly. Among the top-selling brand-name drugs at retail pharmacies, IMS estimated that coupons were used about 8 percent of the time in 2010. By 2015, that had grown to more than 27 percent in those drug classes.

Coupons were used to pay for more than one-third of the best-selling brand-name drugs prescribed last year to treat autoimmune diseases, viral hepatitis, HIV, and multiple sclerosis.

It’s really hard, perhaps by design, for insurance companies and benefit managers to know how often coupons are used and what effect they’re having on plans’ finances and the way benefits are intended to work. Pharmacies process patients’ insurance first and only afterward enter the co-pay coupon. That information is not shared with health plans because it’s basically treated as another method of payment, akin to cash.

Insurers say they are trying to come up with ways to collect these details. They structure their benefit plans — with deductibles and co-payments — to “send a price signal to the patients so that they choose the most cost-desirable product,” said Steve Miller, chief medical officer of Express Scripts, a large pharmacy benefit manager. “The co-pay card abrogates that. … None of us have come up with a very good solution about how to solve that.”

The pharmaceutical industry says coupons are an effort by companies to keep their products affordable to the end user, the patient.

Express Scripts has started refusing to cover some drugs, in part based on whether their makers issue co-pay coupons. If the drug isn’t covered, “your co-pay card becomes null and void,” Miller said.

The pharmaceutical industry says coupons are an effort by companies to keep their products affordable to the end user, the patient. Insurers have lots of tools to control who uses a particular drug, officials say, such as requiring prior approval from the health plan, mandating that patients try less-expensive medications first, and placing limits on how many pills can be dispensed per month.

But as insurers seek to push more costs to consumers, drug companies are doing what they can to help, said Jenny Bryant, senior vice president for policy and research at the Pharmaceutical Research and Manufacturers of America, the industry trade group. “My sense is that we’re past the point where there’s a question about whether these kinds of programs are necessary,” Bryant said. “The reality is that [insurance] benefits are not as generous as they were, and many patients are struggling.”

Even the coupons don’t always cover the entire cost of pricey drugs such as Ciprodex.

Alcon, a subsidiary of Novartis that makes the drug, did not answer specific questions about how often its coupon has been used. Instead, in a statement, it said that the coupon “helps eligible commercially insured patients who need this medication gain more affordable access.”

Could my son have used a cheaper alternative? In theory, that’s the question my insurer would have expected me to ask at the outset. But Peter Weber, an otolaryngologist and director of the ear institute at the New York Eye and Ear Infirmary of Mount Sinai, said doctors prefer Ciprodex for swimmer’s ear because it combines an antibiotic with a steroid and poses less risk if the eardrum is not intact. Because there’s no less-pricey equivalent, doctors often mention the co-pay coupon when they prescribe it.

“This is a drug that works, it’s a drug that we want to use, and we have no control over the pricing,” Weber said, adding, “half the time, we get calls from pharmacists that say, ‘Look, they can’t afford it’ … and I get that. It’s not good.”

||

This story originally appeared on ProPublica as “Are Copay Coupons Actually Making Drugs More Expensive?” and is re-published here under a Creative Commons license.