Most of it to the super wealthy.

By Kate Wheeling

(Photo: Spencer Platt/Getty Images)

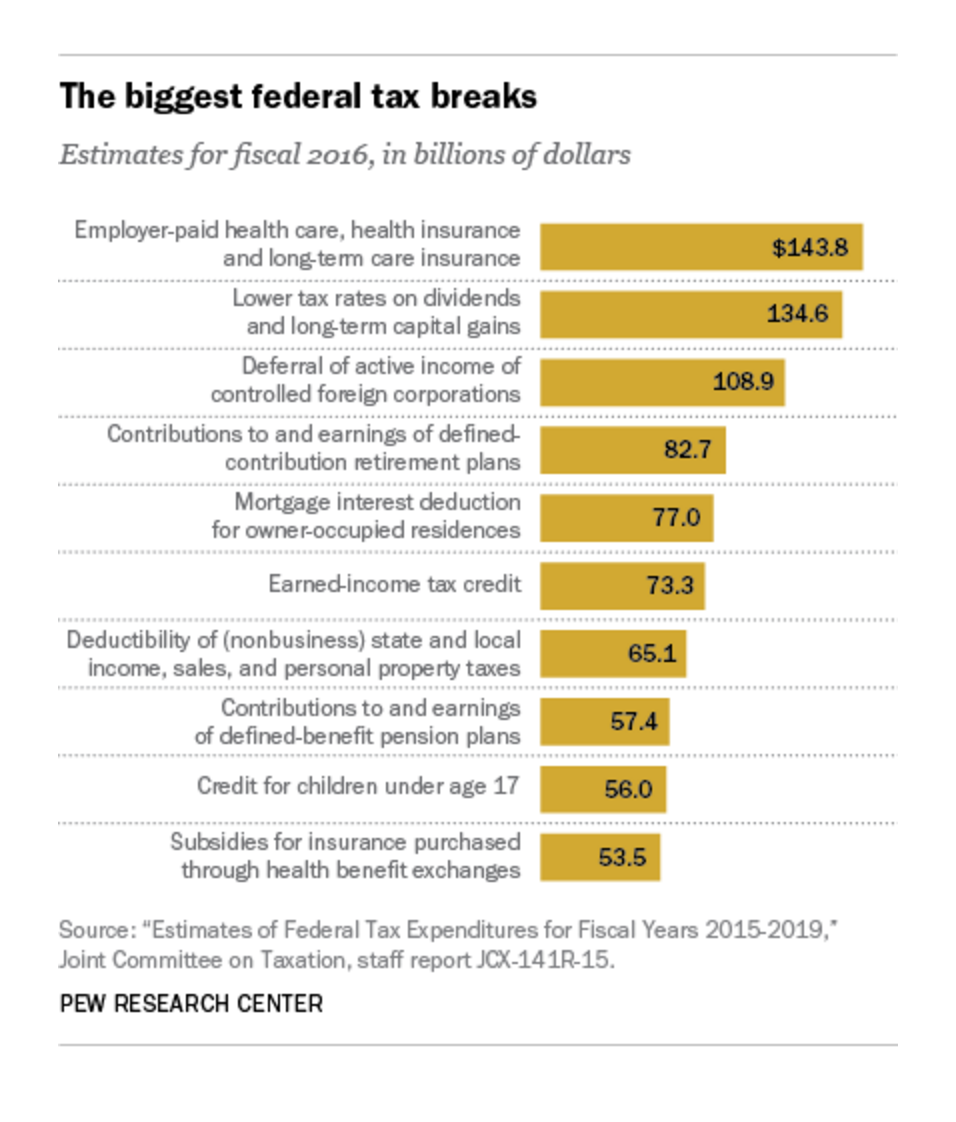

It’s every American’s favorite time of year—tax season. This year, Congress’ Joint Committee on Taxation estimates that the government will lose at least $1.3 trillion in 2016 to various tax breaks — the exemptions, deductions, and credits allowed by the Internal Revenue Service.

(Graph: Pew Research Center)

Some $185 billion of that will go back to businesses and corporations, according to the Pew Research Center, while roughly $1.15 trillion will end up in the pockets of individuals, many of them already uber-wealthy. Eighty percent of the money from mortgage and property tax deductions, for example, will go to Americans making at least six figures a year. But the Earned Income Tax Credit does more for your average American (who probably makes closer to $53,046); 80 percent of the $73.3 billion the government will give up in 2016 to the EITC will go to individuals who make less than $40,000 per year.

That $1.3 trillion is just a portion of the money the government will lose to tax breaks and credits this year; the joint committee only analyzed exemptions that cost the government at least $50 million per year.

Get these tax breaks while you can, because tax reform may finally be on the agenda after the 2016 election. Each candidate has released their reform proposals, and luckily there are multiplehandy tax calculators out there you can use to estimate what your taxes will look like under a Donald Trump, Ted Cruz, Bernie Sanders, or Hillary Clinton presidency.

||