While working at a pharmaceutical consulting company—the kind that offers drug companies advice on how much to charge for their latest and greatest treatments—David Howard was struck by how much guesswork goes into drug price estimates. In most markets, companies face concrete constraints on pricing, according to Howard, now an associate professor of health policy and management at Emory University, but “in the pharmaceutical market, and particularly the market for cancer drugs, that’s not the case.”

The prices of anti-cancer drugs can be astronomical—$120,000 buys a single course of ipilimumab, a drug for melanoma, and an average of four extra months of life for cancer patients—and anecdotal evidence has long suggested that those prices have been growing. In fact, when Howard and his colleagues looked at the inflation-adjusted prices of anti-cancer drugs released since 1995, they found that the costs have been increasing by roughly 10 percent every year.

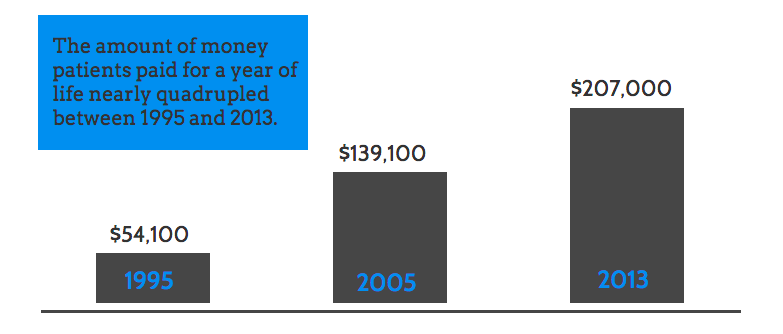

The team compared the price of 58 new anti-cancer drugs launched over the last two decades to data on the survival benefits, or how much extra time the treatments bought patients, of each drug. The more effective drugs tended to be more expensive, the team reported in the Journal of Economic Perspectives. For every extra year of life a drug gave back to patients, prices jumped up by 120 percent (though it should be noted that, even for the best drugs, borrowed time is almost always measured in months, not years). And despite the fact that newer drugs were not necessarily associated with better survival outcomes, their prices still rose over time, increasing by about $8,500 per year. That means patients (or, more likely, their insurance companies) are paying more money for newer drugs, but not getting greater benefits. In 1995, patients paid $54,100 for one year of life; in 2013 they paid $207,000.

Physicians and hospitals can buy new drugs at wholesale prices and then profit from the difference when they sell them to patients and bill their insurance companies for the retail prices.

There are many potential explanations for why prices have climbed seemingly unchecked. Manufacturers ratchet up prices incrementally, so increases go mostly unnoticed. Physicians and hospitals can buy new drugs at wholesale prices and then profit from the difference when they sell the drugs to patients and bill their insurance companies for the retail prices. Even patients are not totally blameless; once we’ve hit our co-pay maximums, what difference does it make to us if a drug costs $20,000 or $200,000? Private insurance companies risk backlash from physicians and patients if they refuse to cover a drug, and Medicare is required by law to cover all FDA approved drugs, regardless of price.

“To the extent that anything really forces a sudden shift, it will be a need to curtail or rein in Medicare spending,” Howard says. Short of that, as long as doctors continue to prescribe new drugs and insurance companies continue to pay high prices, manufacturers will continue to charge exorbitant rates.

“There are potentially more expensive drugs coming,” Howard says. “We don’t know what the prices are going to be yet, but indications suggest that they will be even higher than existing drugs.”

Quick Studies is an award-winning series that sheds light on new research and discoveries that change the way we look at the world.