In October of 2016, President Barack Obama‘s Council of Economic Advisers published a report on an economic concept known as labor market monopsony power—the ability of employers in certain markets to set wages (and, potentially, constrain wage growth). In the report, Council of Economic Advisers economists examined both the sources and effects of monopsony power as well as potential policy responses.

Since then, the broad topic of employers’ ability to set wages, often at rates below a worker’s worth, has continued to draw attention from policymakers and economists, who have, in recent papers, primarily focused on the effects of employer market concentration on wages and inequality. But in a new report, economists Josh Bivens and Heidi Shierholz of the Economic Policy Institute, a liberal think tank, caution against an exclusive focus on market concentration. Market concentration is a source of employer power, they argue, but it’s far from the only one.

“It’s not just market concentration,” Shierholz says. “There’s lots of ways employers have power. What really matters in terms of the rising inequality and wage stagnation we’re seeing today is the relative power between workers and employers.”

The Great Recession delivered a particularly brutal blow to the wages of most Americans, but earnings for most workers have been growing at a historically slow rate since well before the housing and stock market collapse of 2008. (The exception to this trend is the wealthiest Americans, who have seen their earnings increase astronomically in recent years.)

There are a lot of explanations for this slowdown—productivity growth (which historically drove wage increases) has slowed, and globalization and automation have reduced demand for certain types of American labor.

But the evidence also suggests that the balance of power between workers and employers has changed dramatically since the 1950s, a shift that may be enabling employers to pay workers less than they’re worth, contributing to wage stagnation and increasing income inequality. As evidence of this shift, economists often cite the gap between productivity and wage growth (for typical workers) that has opened up since the 1970s—the gains to productivity are indeed smaller than they once were, but they’re also not being distributed across the income spectrum in the way they once were. The chart below, from a previous EPI explainer on the topic, illustrates EPI’s calculations of the widening gap (the drivers of this gap are a topic of some debate):

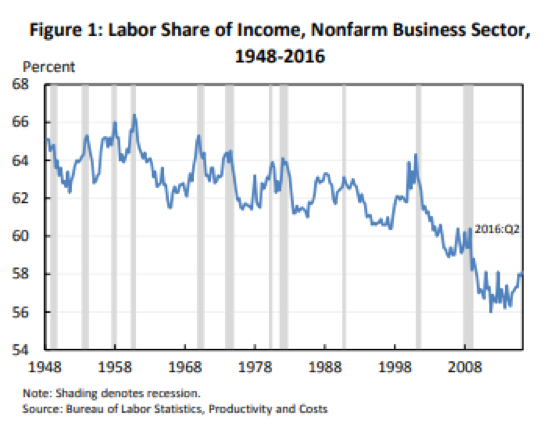

Economists also point to a decline in the share of the national income distributed to labor (loosely speaking, workers) as opposed to capital (loosely speaking, employers and other owners of capital). This graph from the 2016 CEA report illustrates the decline:

Classical economic theories of labor markets typically assume a perfectly competitive market in which each worker is paid what they’re “worth.” In this model, workers who are paid less than they’re worth can quit and instantly find another job at the appropriate wage; firms that fail to pay workers what they’re worth will be unable to hire and retain workers and will eventually be forced to either shut down or increase their wages.

Economists, of course, have always known that this model is a very simplified version of reality, but it’s long been viewed as accurate enough to be useful. These assumptions of perfect competition underlie economic theory on a range of economic policy topics—the minimum wage, for example.

In a labor market monopsony, these assumptions are upended. Here’s how the CEA brief explains what happens when firms operate in uncompetitive labor markets:

[W]hen there are barriers that limit wage competition between firms, market discipline that compels employers to pay the going wage is weakened. In this case, assuming that similarly productive individuals vary in their “reservation wages” (the lowest wage they are willing to accept)—for example, because some must commute from longer distances—a monopsonistic firm faces a choice: it can set the wage high enough to recruit even those with high reservation wages, or it can limit employment to those who are willing to work for less and thereby keep wages low. Economic theory shows that firms with monopsony power have an incentive to employ fewer workers at a lower wage than they would in a competitive labor market.

The simplest theory of labor market monopsony as it’s taught to economic undergraduates usually assumes a “one-company” town in which a single employer has no competitors and a great deal of power over local wages, but there are a lot of factors that can increase employers’ wage-setting power, both in absolute terms and relative to workers’ power. The CEA report outlines many of them: mergers between companies; collusion between different employers surrounding wages or hiring practices; the overuse of non-compete agreements, which limit employees’ abilities to leave their jobs; and other frictions that make it difficult for workers to search for or take other jobs (health insurance, location challenges, regulatory barriers like occupational licensing).

“Basically, any time there’s a case where an employee couldn’t instantaneously quit their job and find another job, that means the employer has monopsony power,” explains Shierholz, the EPI economist. “And then there’s different degrees—there’s the one-company town, there’s the greater challenges that women and people of color face when trying to immediately find another job.”

Economists, however, are still working toward an understanding of the effects of these different factors. In the EPI report, Shierholz and Bevins argue that market concentration, the factor that’s received the most attention in the economics literature to date, is not the dominant factor driving stagnation and inequality. To support their argument, they break the productivity-pay (for the typical worker) gap down into two different components: the part that’s driven by the overall decline in labor’s share of income (which affects workers across the income spectrum) and the part that’s driven by income inequality—i.e. “a decline in the percent of labor’s share of income that is received by low- and moderate-wage workers.”

If market concentration were the primary driver of the productivity-pay gap for the typical worker, you would expect to see the first factor emerge as particularly important. Instead, the opposite is true. The decline in labor’s share of income explains only 16.5 percent of the increase in the productivity-pay gap between 1973 and 2014, while inequality explains 83.5 percent of the gap.

“There has been a notable decline in labor’s share of income, but the bigger factor that’s been eating away at the pay of low- and moderate-income Americans is inequality in the share of aggregate labor compensation that goes to those workers,” Shierholz says. “Concentration is not the whole story—there’s something else going on here.”

Shierholz is careful to point out that she’s by no means opposed to policy proposals that address employer market concentration or to research on the topic.

“This discussion of employer power that the economics profession is grappling with is extremely important and exciting,” she says. “But I worry that there is a risk that this amazing moment could be lost if people say ‘Oh, we were interested in seeing if these new models of employer competition could explain the rising inequality over the last four decades and if they don’t, oh, we’ll go back to the perfect competition model.'”

Economists have some ideas about how to address the outsized relative power that employers currently hold in many labor markets. The CEA report, for example, highlights a number of potential policy responses to these trends, among them regulating the use of non-compete agreements, improving pay transparency, reforming occupational licensing, and wielding antitrust policy to reduce labor market concentration.

Identifying the correct cure, however, requires an accurate diagnosis. Shierholz and Bevins believe that the problem isn’t so much that employers’ absolute power has increased exponentially, but rather that workers’ power has fallen through the floor thanks to a variety of economic forces and policy choices.

“Let’s just acknowledge that what we have always had is employers with strong power, but there used to be institutions that provided countervailing power for workers,” Shierholz says. “The latter has completely been decimated. Since there’s just no way to decimate employer power, the way to solve this going forward is to boost worker power.”