Last month, during a retreat in West Virginia, congressional Republicans set out their 2018 party goals. Their primary objective is to hold onto their majorities in the House of Representatives and the Senate, and the key mechanism for doing so is to ride the coattails of the Tax Cuts and Jobs Act. “The tax bill is part of a bigger theme that we’re going to call The Great American comeback,” said Representative Steve Stivers (R-Ohio), chairman of the National Republican Congressional Committee. “If we stay focused on selling the tax reform package, I think we’re going to hold the House and things are going to be OK for us.”

More than 50 percent of the tax bill’s benefits will go to the wealthiest 5 percent of Americans, and more than 25 percent to the wealthiest 1 percent, according to the Institute on Taxation and Economic Policy. As Businessweek put it, “President Donald Trump and Republicans sold their $1.5 trillion tax cut as a boon for workers, but it’s becoming clear just two months after the bill passed that the truly big winners will be corporations and their shareholders.”

Pacific Standard‘s original analysis finds that it is the oil and gas industry, including companies that backed the presidency of Trump and whose former executives and current boosters now populate it, that are among the tax bill’s largest and most long-lasting financial beneficiaries.

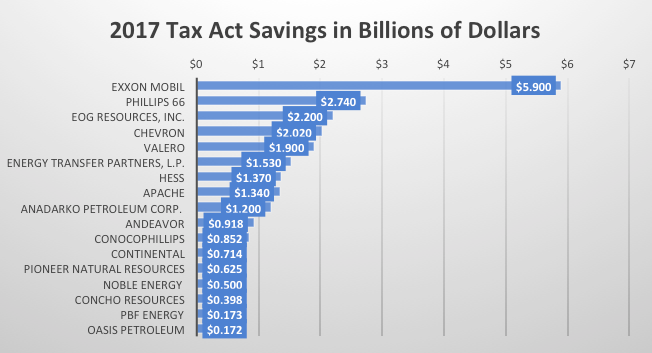

Just 17 American oil and gas companies reported a combined total of $25 billion in direct one-time benefits from the 2017 Tax Cuts and Jobs Act. Many of the companies will also receive millions of dollars in income tax refunds this year. Looking forward, the Tax Act then reduces all corporate annual tax bills by a minimum of 40 percent every year in perpetuity, while adding new benefits that function as government subsidies for the oil and gas industry. The companies’ activities in the United States are made less expensive, thereby encouraging a further expansion of oil and gas operations.

Pacific Standard reviewed the Annual 10K and Fourth Quarter Reports filed with the U.S. Securities and Exchange Commission for 2017 by 17 U.S. oil companies, looking at the largest companies in production, refining, and pipelines that also clearly specified the impacts of the Tax Act in their results. Private companies, such as Koch Industries, which undoubtedly benefit from the legislation, could not be included because they are not required to make these financial reports publicly available.

$25 Billion in Oil Company Tax Savings

Energy giant ExxonMobil reported $5.9 billion in immediate tax savings as a result of the Tax Cuts and Jobs Act, yielding not only the highest oil industry payout, but also ranking it second only to Apple as the nation’s single largest corporate beneficiary of the GOP tax bill.

Secretary of State Rex Tillerson is the former chief executive officer of ExxonMobil (deferring investments in Exxon during, and for 10 years after, his public service, which ends on March 31st) and past chairman of the American Petroleum Institute, which lobbied aggressively for the Tax Act.

Chevron and ConocoPhillips, the second- and third-largest U.S. oil companies after ExxonMobil, received $2.02 billion and $852 million in tax savings, respectively. Energy Transfer Partners, the company behind the Dakota Access, Bayou Bridge, and Rover oil pipelines, a large financial backer of candidate Trump, and on whose board Energy Secretary Rick Perry previously served, reports receiving $1.53 billion. Like many other oil pipeline companies, Energy Transfer Partners is organized as a Master Limited Partnership; a corporate structure specially rewarded in the Tax Act with an extra tax rate reduction.

The nation’s leading refiners came out big, with the second-highest overall Tax Act savings behind ExxonMobil going to Phillips 66 with $2.74 billion, and Valero rounding out the top five oil company beneficiaries, with just under $2 billion.

All totaled though, it may be the nation’s domestic oil and natural gas frackers who received the biggest combined immediate rewards from the Tax Act. EOG Resources, for example, garnered the third-highest oil sector pay-back with $2.2 billion in tax savings, followed by Hess at $1.37 billion, Apache at $1.34 billion, Anadarko at $1.2 billion, Andeavor (whose North Dakota oil refinery served as backdrop to Trump’s speech pitching passage of the Tax Act last September) at just under $1 billion, and Continental Resources at $714 million. Continental’s Harold Hamm, a staple figure at Trump’s side at addresses before oil industry audiences (including when Trump pitched the Tax Act), is regularly credited as a guiding force behind Trump’s domestic energy policy.

Foreign-based Shell and BP each reported initial losses as a result of the Tax Act at $2 billion and $1.5 billion respectively, stemming from changes in the rules governing the use of past losses to offset future profits. Each company, however, was quick to point out in public statements that it expects the future impacts of the legislation to be positive due to the slashing of the corporate tax rate.

Less Than Zero: The Actual Tax Rate

The Institute on Taxation and Economic Policy, a non-partisan think tank that analyzes tax policy issues, delved even deeper into the 10K’s of 11 of these oil companies for Pacific Standard. ITEP found that, in addition to the one-time tax savings, five of the 11 companies will actually receive federal income tax refunds this year. American taxpayers will send California’s Chevron a check for $382 million, as well as checks to Apache for $38 million, Marathon Oil for $32 million, Hess for $23 million, and Pioneer for $5 million.

…With Many More Billions to Come

The Tax Act has many benefits for corporations, most notably a permanent slashing of the corporate tax rate from 35 percent to 21 percent, or a 40 percent cut in company tax bills. These immediate $25 billion in oil company benefits are primarily the result of companies that had deferred payment of taxes they owe to some point in the future. The more billions of dollars they deferred, the more savings they got from the Tax Act. This is because money that they would previously have been required to pay a tax rate of 35 percent on is now taxed at just 21 percent. But that is only the beginning.

“There’s a gigantic payoff going forward, which is that their tax bills just got reduced by 40 percent,” explains Matt Gardner, a senior fellow at ITEP. “A bunch of companies already paying very low tax rates are now seeing those tax rates drop even further.”

While the nominal tax rate was 35 percent, few companies actually pay this amount. It is more of a starting point from which companies then utilize newly added and pre-existing loopholes, giveaways, and other advantages to reduce the amount of money they actually pay. The result is known as their “effective tax rate.”

“In the case of Exxon, they have never in the past five years paid anything close to a 35 percent U.S. tax rate on income,” Gardner says. “And now their already low tax rate is being slashed by another 40 percent.”

(Photo: Scott Olson/Getty Images)

As a result of the Tax Act, ExxonMobil’s effective tax rate on its U.S. federal income fell from just 3.7 percent in 2016 to a negative -85.6 percent in 2017, according to the IETP analysis. Fellow negative-tax-rate beneficiaries include Anadarko at -17.2 percent, Pioneer at -1.6 percent, and ConocoPhillips at -1.5 percent. In 2017, only Chevron and Valero paid more than a 6 percent effective federal income tax rate of the 11 companies studied.

This oil company bonanza was the anticipated result of a bill well crafted for this purpose. Forbes predicted in mid-December that, while the Tax Act would be a boon for all of corporate America, it was energy companies in particular that “stand to benefit the most.”

One reason is that, while often dramatically lower than their statutory tax rates, on average, the oil industry’s income taxes run higher than the overall S&P500, and thus the 40 percent reduction disproportionately helps them. In addition, with their often-substantial foreign operations, the Tax Act’s reduction on how some foreign holdings “repatriated” to the U.S. are taxed adds another benefit. But before you get too excited at the idea of billions of corporate dollars potentially pouring back into the U.S. from abroad, Dean Baker of the Center for Economic Policy Research explains that companies could simply make a paper switch amounting to little more than shifting money in one account at Citigroup under a foreign subsidiary’s name to another account under the name of the U.S.-based parent company, “which means essentially nothing to the U.S. economy,” but could mean billions in tax savings to the company.

In addition to keeping virtually all of the oil industry’s substantial existing tax breaks, the Tax Act provides a new subsidy for how the companies deduct the costs of capital expenditures such as drilling equipment, lowering their tax burden while encouraging more capital spending, with the likely result of increased production and other operations. And finally, the bill also opened part of Alaska’s Arctic National Wildlife Refuge to oil and gas development.

All totaled, the tax breaks make operating an oil and gas company in the U.S. cheaper today than it was yesterday, which will encourage more operations across the board. The research organization Wood Mackenzie estimates that the combined effect of these and other provisions in the Tax Act for oil and gas exploration companies alone “should mean a post-tax increase of 19 percent, or $190.4 billion.”

“It’s a win-win” for the oil companies, Gardner says. “The only real losers in our fiscally challenged environment are everybody else who will have to foot the bill for these tax cuts in the long run.”