Last week, the Congressional Budget Office released its annual report predicting future economic growth, tax revenues, and budget deficits. The report, which predicts strong economic growth in 2018 and 2019 due to recent “fiscal policy changes,” has nonetheless caused a bit of heartburn among Trump administration officials and fiscal conservatives in Washington, D.C., due to its deficit projections. The CBO projects a deficit—which the agency describes as “large by historical standards”—of $804 billion in 2018, or 4.2 percent of gross domestic product (GDP).

And those jaw-dropping deficit numbers just keep going up. “In CBO’s projections, budget deficits continue increasing after 2018, rising from 4.2 percent of GDP this year to 5.1 percent in 2022 (adjusted to exclude the shifts in timing),” the CBO concludes. “That percentage has been exceeded in only five years since 1946; four of those years followed the deep 2007–2009 recession.”

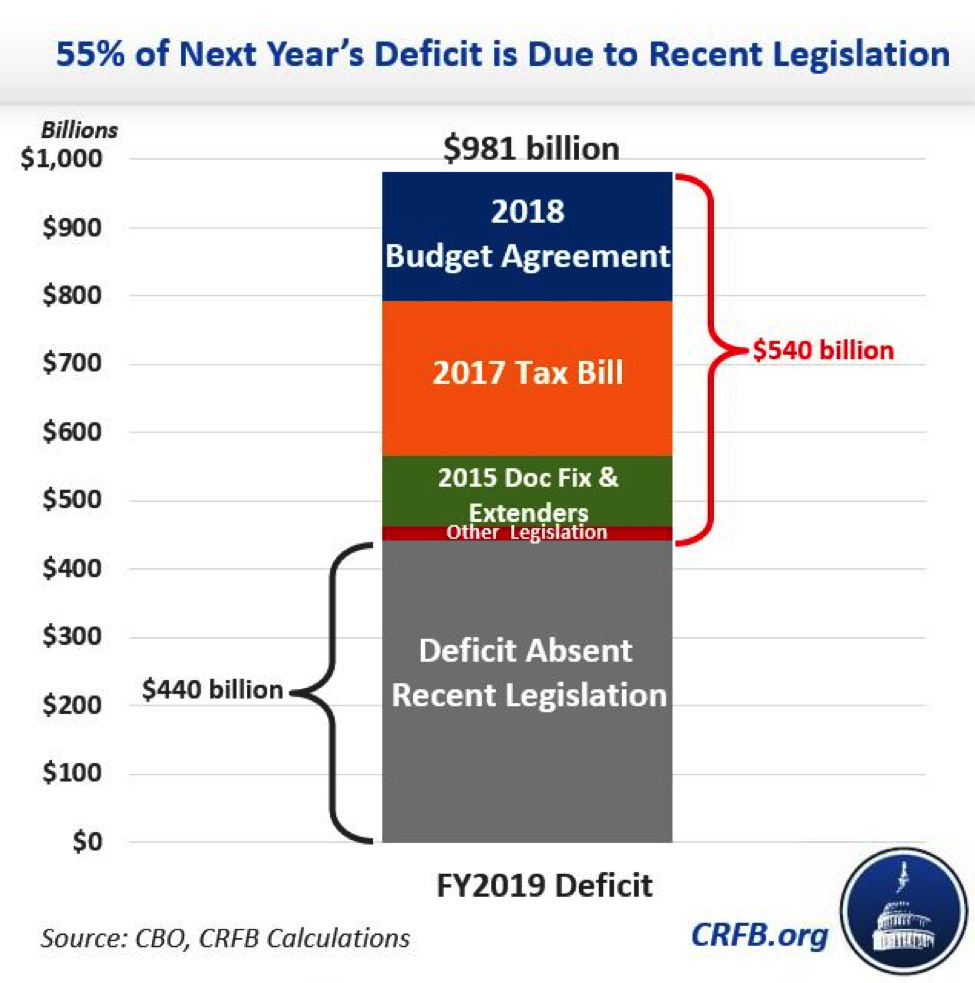

So what’s to blame for all that new red ink? The chart below, from the Committee for a Responsible Federal Budget, breaks it down:

While health-care costs and the aging population continue to be major contributors to long-term deficits, it’s two recently passed pieces of legislation that are driving the big near-term spikes: The tax reform legislation that passed on party lines last December and the bipartisan budget compromise passed earlier this year. It seems that Republican control of Congress and the White House has not, as David Leonhardt points out in a recent column for the New York Times, produced a promised era of fiscal rectitude.