THE ISSUE: Californians have battled over taxes since the passage of the property tax-limiting Proposition 13 in 1978; ever since, the state and its voters have built taxes on that system, creating the most centralized, complicated system of raising revenue of any American state. That system has, for a variety of reasons, made it hard for the state to balance its budget in the short term, or to make major policy plans for the long term.

THE BACKSTORY: The Think Long committee considered altering Prop 13 and its property tax measures, but the topic was too difficult. The more-conservative Think Long members pushed for a flatter system, with lower rates on income. The liberals wanted more revenues for state services starved by a decade of cuts. Nicolas Berggruen pushed the committee staff to find ways to do both.

California Issue

What is Think Long thinking?

The Think Long Committee developed specific recommendations for improving California’s governance. Joe Mathews offers an in-depth look at seven specific areas afflicting the state, and what the reform organization proposed as remedies. The other six areas are:

Voter Initiatives

State Budget Deficit

Jobs

Citizens’ Council

Education

Local Government

The committee considered a wide range of proposals, and heard from conservatives (Stanford’s John Cogan) and liberals (UC Berkeley’s Alan Auerbach). Among the more striking early proposals were a three-rate system that would raise taxes on all income levels (up to 15 percent for income above $300,000), and the development of a smartphone app to help Californians determine their tax levels.

Committee staffers had four instructions. First, lower rates on taxes to make California more competitive. Second, raise revenues so that the state would raise $10 billion more a year that could go to schools, higher education, and other services. Third, tax the whole economy.

And as the committee debated deeply – with the crucial context of the Occupy movement’s appearance in American cities — a fourth priority arose. Liberals in the group, who initially seemed OK with flatter taxes, demanded that the progressivity of the current system be preserved.

To do all that, committee staff modeled 23 different tax scenarios. They discussed a much higher tax rate for the very rich at one point. A European-style business net receipts tax was considered, but dismissed for political reasons. (A previous tax commission had recommended this, but the idea had gone nowhere.)

Consensus lay in the insight that since the state sales tax applied only to goods, half of California’s economy – the service sector – wasn’t being tapped for revenues. And this was the half that was growing. The committee would adopt taxing this sector, with two big exemptions: The services sales tax would not apply to health care and education expenditures.

The committee hired a pair of experts highly respected in Sacramento (if unknown elsewhere) to help with modeling. They had to come up with reliable estimates for a sales tax on services that didn’t exist, and to do that had to come up with smart estimates of data that didn’t yet exist—on sales in each piece of California’s diverse service economy.

From there, the committee conducted “incidence modeling” to figure out how to set the new income tax rates, the new states sales tax rates, and other tax rates. The goal was to make sure, through the modeling, that the entire tax package didn’t advantage or disadvantage particular income groups. Instead, everyone would have to pay a very small amount more of effective tax.

THE PROPOSAL: The first models showed that reducing the income tax rates—from six brackets to two, and the top rates from 10.3 percent to a range between 6.5 and 8 percent—and establishing the sales tax on services imposed a greater new burden on middle class Californians than richer Californians. So the committee created a new income tax break to prevent lower income and some middle class families from paying income taxes. After more modeling of that new figure, the Think Long tax package did the trick, at least in the model. All income groups would all be paying between 0.2 and 0.5 percent more – preserving the progressivity of the system.

“Nobody loved it,” says Antonia Hernandez, a committee member. “The fact that nobody loved it was an accomplishment in itself.”

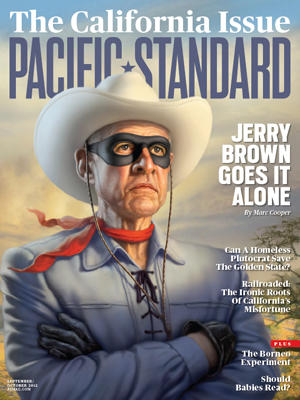

Despite this hard-won consensus, and what committee staff and members describe as consultations with Gov. Jerry Brown’s administration, the tax plan did not win the support of the governor. Instead, Brown’s own plan, a compromise with public employee unions that temporarily adds to the current rates without any reform, appears on this November’s ballot.