The Senate GOP’s Better Care Reconciliation Act of 2017 makes a number of changes to the structure of the Affordable Care Act’s insurance subsidies: It ties tax credits to less-generous benchmark plans (so the credits are about 15 percent smaller in general), changes the income eligibility guidelines for the subsidies (reducing the upper limit to 350 percent of the poverty line, from 400 percent), and alters the subsidies to redirect more assistance to younger people (and away from older people).

The Congressional Budget Office score released yesterday projected that these changes would lead average premiums on benchmark plans (plans which would, by definition, be less generous) to increase in 2018 and 2019, and then decrease thereafter. That average, however, obscures a wealth of complicated caveats—in actuality, the premiums that a person would pay depends on their age and income level, and on the type of insurance coverage they’d like to purchase.

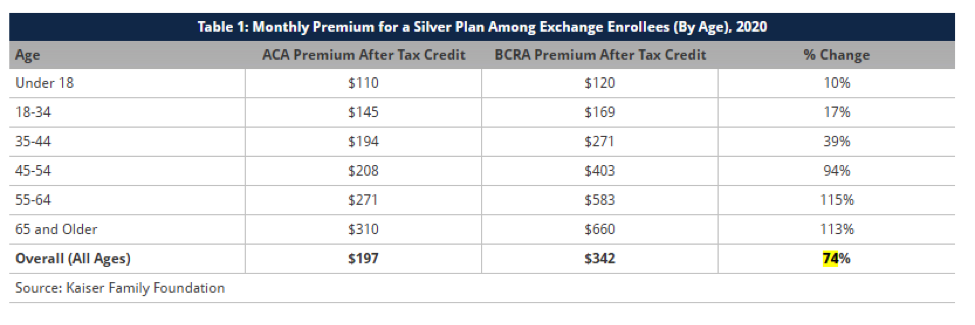

A new analysis from the Kaiser Family Foundation attempts to shed some light on those caveats by comparing premiums (after tax credits) under both the ACA and the BCRA, by both age and income level, for comparable, silver-level plans. Here’s what they found:

Overall, individuals would pay about 74 percent more (after a premium tax credit) for the same silver-level plan under the BCRA as under the ACA. Older Americans, however, would see larger increases. Americans aged 55 to 64 would pay 115 percent more for comparable plans under the BCRA.

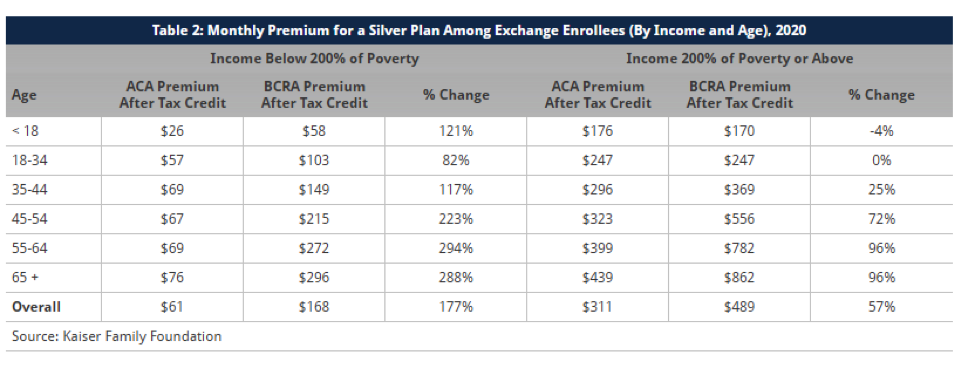

Consistent with the CBO’s analysis, the hardest-hit would be older, lower-income Americans, as the KFF chart below demonstrates:

For Americans between the ages of 55 and 64, earning less than 200 percent of the poverty line, premiums for a comparable silver-level plan would be 288 percent higher under the BCRA than under the ACA.

The fate of the BCRA is uncertain at this point—Senate Majority Leader Mitch McConnell has delayed a vote on the bill until after the July recess. Numbers like these, however, have to be worrying senators with large numbers of older, low-income constituents.